Netflix doubles down on Warner Bros. Discovery deal despite public pushback

Netflix’s US$82.7B acquisition of Warner Bros. Discovery triggers industry scrutiny, labor opposition, and a rejected Paramount counterbid

Netflix is charging ahead with its US$82.7 billion acquisition of Warner Bros. Discovery (WBD), defying criticism from labor groups, lawmakers, and competitors.

The move, intended to reshape the global entertainment landscape, comes with promises of growth, creative opportunity, and theatrical revival. But not everyone’s convinced.

This article explores how Netflix is responding to mounting pressure around the deal, what WBD’s board is signaling, and what the fallout could mean for brands and marketers navigating a volatile content ecosystem.

Short on time?

Here’s a table of contents for quick access:

- What’s happening with the Netflix-WBD merger?

- Why regulators and rivals are pushing back

- What marketers should know

What's happening with the Netflix-WBD merger?

Earlier this month, Netflix announced a definitive agreement to acquire key assets of Warner Bros. Discovery, including its film and television studios, HBO, and HBO Max, in a cash and stock deal valued at US$82.7 billion. The transaction, which offers WBD shareholders US$27.75 per share, follows WBD’s plan to spin off its cable businesses into a separate company called Discovery Global in 2026.

Netflix co-CEOs Ted Sarandos and Greg Peters positioned the deal as pro-growth and pro-consumer. In a public letter, they emphasized their intent to retain Warner Bros.’ theatrical division, avoid studio closures, and maintain creative jobs.

“The Warner Bros. Discovery Board reinforced that Netflix’s merger agreement is superior and in the best interest of stockholders,” Sarandos said in a shareholder letter. Peters added the acquisition would bring “more value, choice, and opportunity” to audiences and creators alike.

Why regulators and rivals are pushing back

Not everyone is celebrating.

The Writers Guild of America (WGA) quickly condemned the deal, arguing it violates antitrust protections. The group fears further consolidation will squeeze out creative voices, reduce job opportunities, and drive up costs for consumers.

That concern is echoed by Senators Elizabeth Warren, Bernie Sanders, and Richard Blumenthal, who submitted a letter to the US Department of Justice urging closer scrutiny. They warned that the merger could give Netflix excessive control over entertainment distribution, potentially raising prices in a market already under inflationary strain.

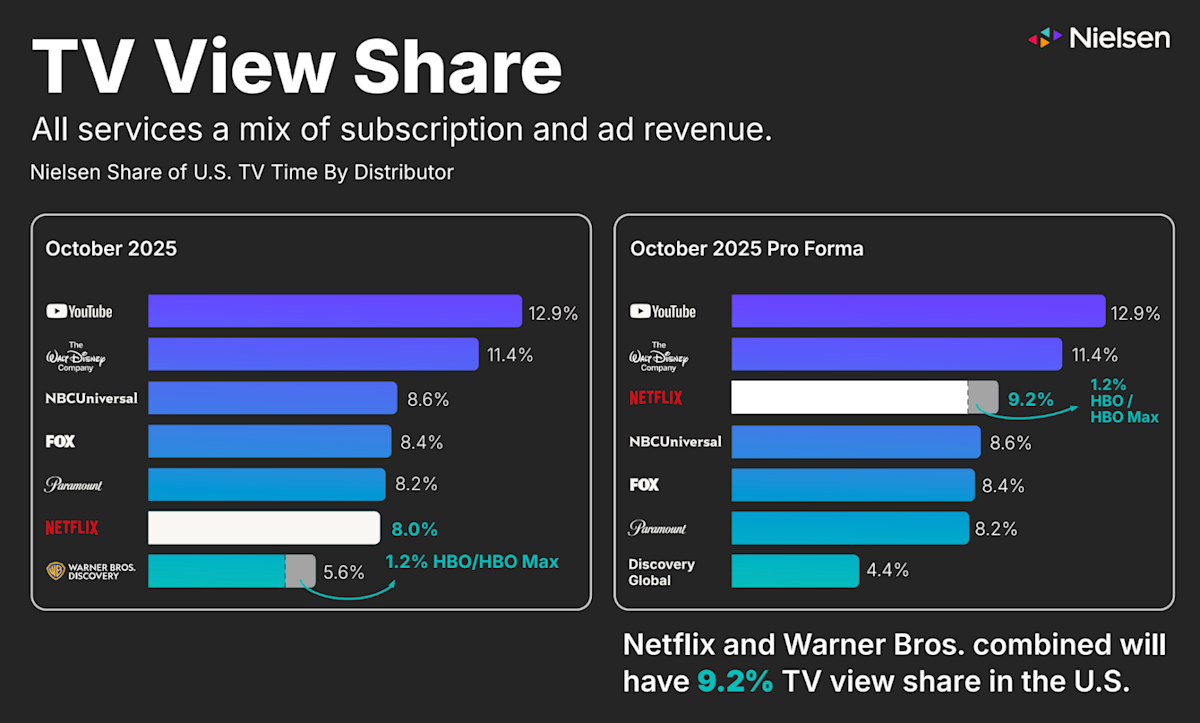

Paramount Skydance also entered the fray, making a hostile US$108.4 billion counteroffer that WBD's board rejected. In response, Netflix cited Nielsen data to downplay monopoly fears, noting that the combined Netflix-WBD share of TV viewership would still trail YouTube and Disney.

The deal also includes a US$2.8 billion breakup fee if WBD reverses course.

What marketers should know

For marketers, the Netflix-WBD merger represents a seismic shift in content distribution and a cue to rethink media strategies. Here’s what to watch:

1. Theatrical content is back in play

Netflix, historically known for skipping the big screen, is now committing to theatrical windows for Warner Bros. films. That signals a renewed focus on event-driven content marketing and box office tie-ins, potentially reintroducing cinema as a viable channel for brand partnerships.

2. Streaming power consolidation raises risks

If the merger goes through, two dominant streamers, Netflix and Disney, will command outsized control of premium content. Brands may face higher ad rates or reduced inventory as fewer platforms hold more leverage. Diversifying content spend across emerging services could hedge that risk.

3. Franchises could unlock cross-platform marketing

With Warner Bros. IP in hand (think: Game of Thrones, DC Universe, The Sopranos), Netflix could accelerate franchise licensing and co-branded campaigns. Marketers in CPG, gaming, or fashion may find fresh opportunities to ride pop culture momentum.

4. Expect policy-driven delays

Netflix projects the deal to close within 12 to 18 months. But antitrust investigations in the US and EU could slow that timeline. Marketers should monitor policy updates closely, especially those working with media buyers or entertainment affiliates.

Netflix’s push to acquire Warner Bros. Discovery signals more than just a content grab. It’s a play for long-term storytelling power and the latest chapter in streaming’s evolution from disruptor to gatekeeper.

While the platform promises growth and global reach, marketers should prepare for a more centralized content landscape. The next year will test whether that consolidation stifles or strengthens creative collaboration across the industry.