AI and urgency are reshaping APAC’s B2B buying process according to Green Hat report

Green Hat’s 2025 research reveals why B2B marketers must rethink buyer engagement timing

B2B buyers in Asia-Pacific are speeding up their purchase journeys, connecting with vendors earlier, and making decisions faster than they did just a year ago.

That’s one of the standout takeaways from Green Hat and 6sense’s 2025 APAC B2B Buyer Journey Research Report. Based on insights from 632 organizations across the region, the report outlines significant shifts in buyer behavior. These include shorter decision cycles, leaner buying teams, and earlier points of contact with vendors.

This article breaks down what’s changed, what’s driving the shift, and how marketers can adjust their strategy to remain competitive.

Short on time?

Here’s a table of contents for quick access:

- Buying cycles are shorter, and teams are smaller

- AI is prompting earlier seller engagement

- Past experience still drives final decisions

- What marketers should do now

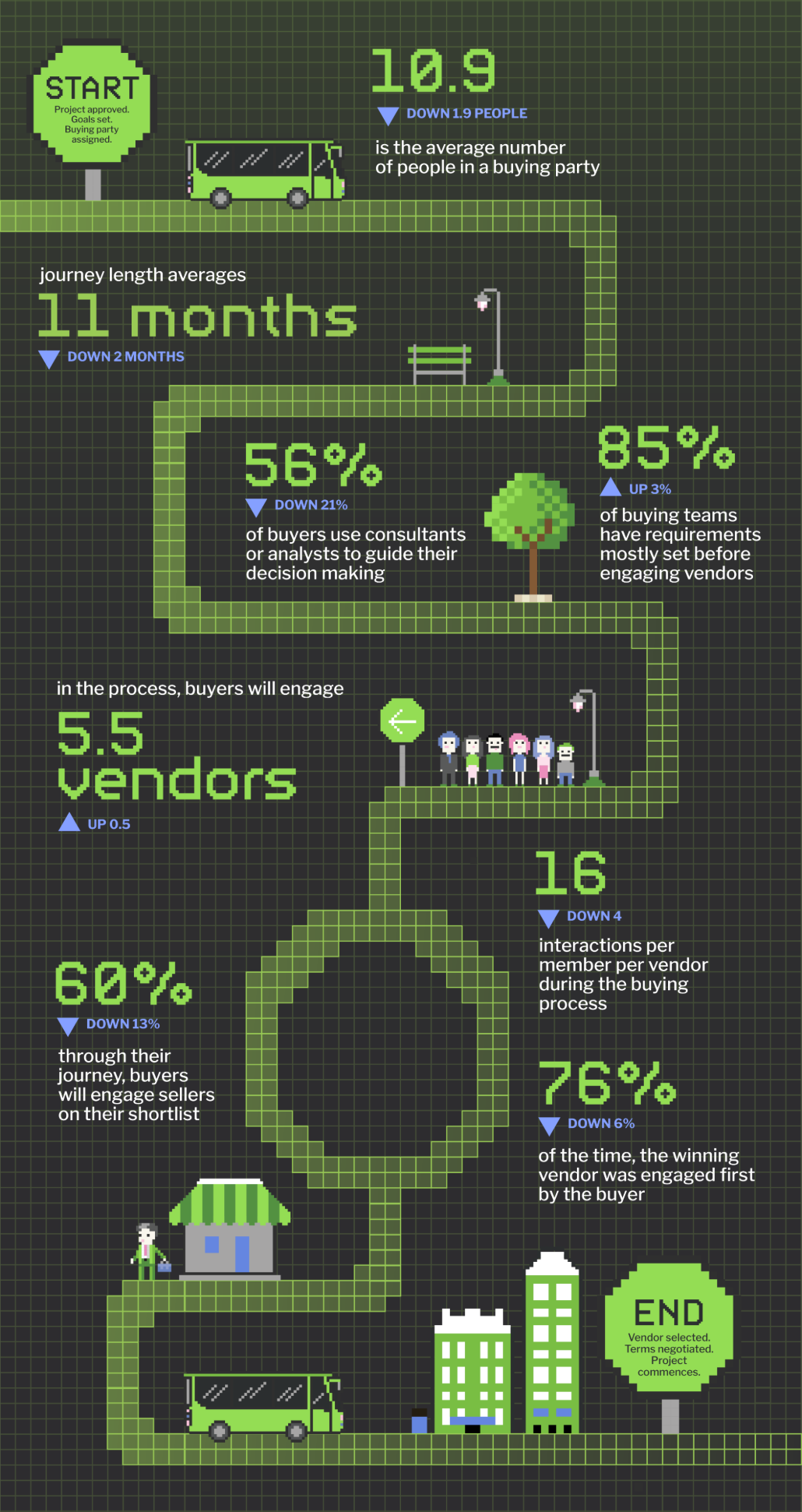

Buying cycles are shorter, and teams are smaller

In APAC, the average B2B buying journey is now 11 months, down from 13 months in the previous year. Buying teams are also smaller, averaging 11 people compared to 13 last year.

Buyers are reaching out to vendors sooner. In 2024, the point of first contact happened when buyers were about 73 percent through the process. This year, that number dropped to 60 percent—meaning seller engagement is happening roughly 12 weeks earlier.

Despite the time crunch, buyers are evaluating slightly more vendors, up to 5.5 from 5.0. Still, 76 percent of the time, the vendor that tops the shortlist becomes the final choice.

AI is prompting earlier seller engagement

Two key forces are reshaping B2B buying behavior: the rise of AI and ongoing economic pressure.

Buyers are turning to vendors earlier in the process because they need clarity on how AI is embedded into products. While vendor websites often promote AI, they rarely explain what’s actually included. That lack of detail is pushing buyers to initiate conversations sooner. In fact, 58 percent of global buyers said they reached out early just to understand the “AI inside” story.

Meanwhile, nearly half of APAC buyers said economic uncertainty shortened their timeline and motivated them to make faster decisions. With budget cycles tightening, there’s less room for drawn-out selection phases.

The takeaway: the buying process hasn’t fundamentally changed, but the timeline has. Marketers must now deliver clear, defensible information earlier in the journey.

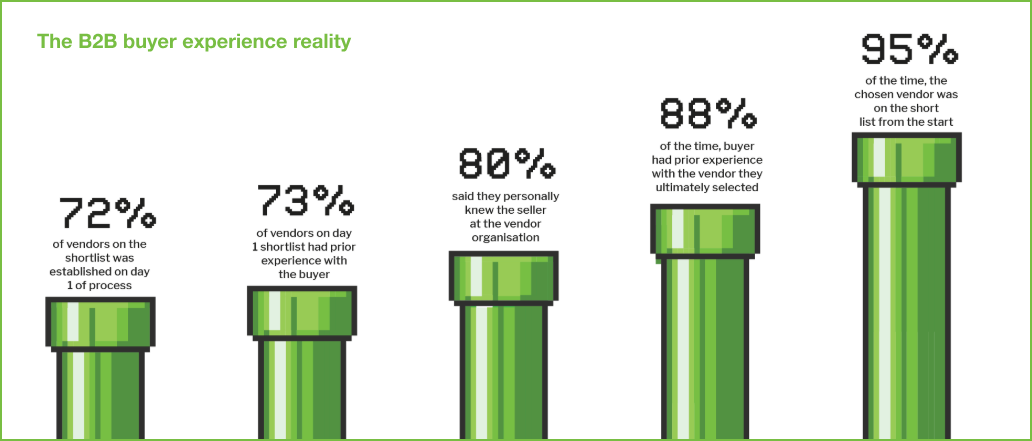

Past experience still drives final decisions

Even with AI tools and faster cycles, familiarity remains the biggest factor in vendor selection.

According to the report:

- 95 percent of winning vendors were already on the shortlist at the start

- 88 percent of buyers had prior experience with the chosen vendor

- 80 percent said they personally knew someone at the vendor’s company

The research also found that 72 percent of shortlisted vendors were known to the buyer on day one. That means buyers are rarely discovering vendors through campaigns alone. Instead, they’re validating what they already know.

Reputation, ease of use, pricing, and brand familiarity all outranked new features as reasons for winning deals.

What marketers should do now

With the Selection Phase compressed and reputation playing a larger role, marketers need to rethink both messaging and timing. Here’s what to prioritize:

1. Get shortlisted early, or get left out

The vendor that tops the shortlist wins three out of four times. That means being visible before the buyer hits “contact us.”

- Build brand awareness with always-on campaigns

- Optimize content for discoverability through SEO and third-party platforms

- Arm Sales with content that supports defensibility—think ROI calculators, comparison pages, and customer success stories

2. Be transparent about your AI capabilities

Buyers are not impressed by vague AI claims. They want clarity on features, cost, data handling, and security.

- Create “AI Inside” guides that explain core capabilities and pricing

- Publish privacy and security policies in plain language

- Equip your Sales team with fast-access talking points on AI infrastructure

3. Don’t ignore reputational buyers

Every APAC buying group includes hidden stakeholders like CFOs and risk managers. They may not attend discovery calls, but they still influence the decision.

- Develop content specifically for finance, compliance, and IT roles

- Use ABM to engage the full buying team—not just technical evaluators

- Prioritize formats that are easy to circulate internally, such as one-pagers and explainer decks

4. Evolve your measurement model

Move beyond MQLs. Instead, focus on buying group signals and account-level engagement.

- Track Marketing Qualified Accounts (MQAs) using intent data

- Monitor share of search and branded AI queries

- Report on pipeline influence, not just leads

The B2B buyer in APAC is acting with more urgency, more knowledge, and more pressure than ever before. If you’re not known and trusted at the start, you likely won’t make the shortlist—let alone win the deal.

Marketers who adapt to this shift by focusing on early visibility, clear AI communication, and whole-group engagement will be the ones who thrive. The clock is ticking, and the Selection Phase is now your most critical battlefield.