APAC’s brand perception winners in November 2025

YouGov’s latest rankings spotlight the brands gaining ground with consumers across Australia, Indonesia, Malaysia, and Thailand

Brand perception is more than a vanity metric. It’s a pulse check on how audiences feel about a company and a leading indicator of purchasing intent, loyalty, and word-of-mouth momentum.

For marketers in Asia-Pacific, keeping tabs on these shifts offers both strategic foresight and competitive context.

This article explores YouGov’s Biggest Brand Movers in APAC for November 2025, spotlighting which brands saw the most significant month-on-month perception gains across four major markets: Australia, Indonesia, Malaysia, and Thailand. From food to fintech, these movers reveal the tactics and trends marketers should be watching closely.

Short on time?

Here’s a table of contents for quick access:

- Australia: Nanna’s and Microsoft gain traction

- Indonesia: Mie Gacoan leads in consumer buzz

- Malaysia: Xiaomi and Setel make perception strides

- Thailand: Rejoice and Maybelline dominate the charts

- What marketers should know

Australia: Nanna's and Microsoft gain traction

Australia’s top brand for November is Nanna’s, a frozen food brand that saw gains in Value, Quality, and Recommendation metrics. This suggests that cost-conscious consumers are re-evaluating household staples with more favorable sentiment.

Runner-up Peroni climbed on the back of improved Corporate Reputation and Purchase Intent. Meanwhile, YouTube saw lifts in Ad Awareness and Customer Satisfaction, likely reflecting tweaks in the platform’s ad experience or content strategy.

Booking.com and Microsoft rounded out the top five. Both brands benefited from boosts in perceived Value and Consideration, with Microsoft possibly gaining from seasonal campaigns or product announcements.

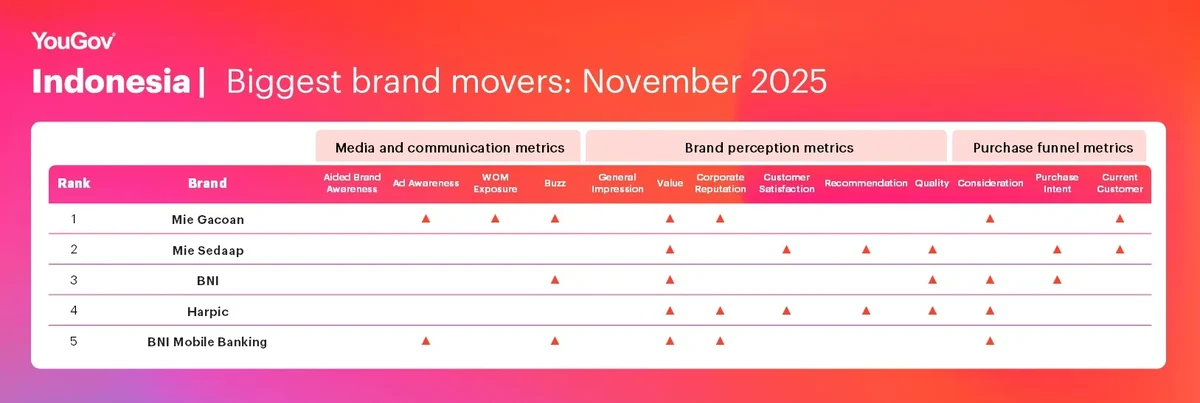

Indonesia: Mie Gacoan leads in consumer buzz

Mie Gacoan topped Indonesia’s chart with uplift in 8 out of 13 metrics, including WOM Exposure, Value, and Current Customer. The brand’s visibility and resonance with customers signal a successful push into both awareness and conversion.

Mie Sedaap followed closely with gains in Quality and Purchase Intent, reinforcing how competition in the instant noodle segment is heating up. BNI and BNI Mobile Banking made notable gains as well, showing that consumer trust is growing in both traditional and digital finance.

Harpic, a legacy cleaning brand, also gained in Value and Corporate Reputation. Its rise hints at continued consumer focus on hygiene and household care.

Malaysia: Xiaomi and Setel make perception strides

In Malaysia, Xiaomi emerged as the top mover with gains across nearly every perception metric. From WOM Exposure to Purchase Intent, the electronics brand continues to position itself as a smart choice for value-focused tech buyers.

Setel, the fuel payment app backed by Petronas, made a strong showing with increases in Ad Awareness and Consideration. As fuel prices and convenience expectations evolve, the app’s growth reflects broader trends in mobile-first utility.

Legacy names like Head & Shoulders and AirAsiaGo also saw meaningful gains. Apple Watch rounded out the top five, likely benefiting from wellness positioning or cross-promotional marketing during Q4.

Thailand: Rejoice and Maybelline dominate the charts

Rejoice had a near sweep in Thailand, improving in 12 of 13 brand metrics. The brand not only led in perception but also moved consumers down the funnel with boosts in Consideration, Purchase Intent, and Current Customer.

Maybelline wasn’t far behind, logging perception lifts across 11 metrics. With improvements in General Impression, Recommendation, and Quality, the brand appears to be balancing mass appeal with product credibility.

Nestlé, Kasikorn, and Colgate Plax filled out the rest of the leaderboard. Kasikorn’s performance signals rising confidence in the financial sector, while Nestlé and Colgate continue to benefit from strong brand equity and product relevance.

What marketers should know

Here’s what these cross-market shifts signal for brand and marketing leaders:

1. Local FMCG brands are making major perception wins

Brands like Nanna’s, Mie Gacoan, and Rejoice show that regional players are winning with clear value propositions and consistent messaging. Marketers should not underestimate the power of familiarity and category ownership.

2. Digital experience continues to differentiate brands

Setel, BNI Mobile, and Booking.com illustrate how seamless digital experiences translate into stronger brand perception. Whether in banking, travel, or commerce, frictionless CX builds loyalty fast.

3. Ad Awareness and WOM still drive brand momentum

Multiple brands gained perception through visibility and buzz. Marketers should align campaigns that amplify both paid awareness and earned word-of-mouth to capture audience mindshare.

4. Perception metrics are early signals of conversion intent

Metrics like Consideration and Current Customer, when tracked alongside sentiment data, can be early predictors of shifts in market share. Marketers should include brand perception KPIs in regular performance reviews.

Consumer perception is a moving target, but it’s one that smart marketers can use to stay ahead of shifting expectations and sentiment. This month’s brand movers show that visibility, value, and experience still matter most.

By tracking where perception is rising, marketers can better prioritize campaigns, partnerships, and messaging that actually resonate.