Cube report reveals the road ahead for Southeast Asia's e-commerce market

From hypergrowth to 15% annual gains, here’s what the new “Goldilocks zone” of e-commerce means for marketers

Southeast Asia’s e-commerce boom has been a wild ride. Hypergrowth, pandemic surges, and now a return to something more grounded. But while the growth has cooled, the opportunity is still massive.

This article explores Cube’s recent report on how the region’s online shopping ecosystem has evolved, why the current phase marks a strategic turning point, and what sellers need to do to compete in a maturing, but still expanding, market.

Short on time?

Here’s a table of contents for quick access:

- The E3SR journey: how e-commerce matured across Southeast Asia

- What recovery growth looks like today

- How sellers can win in the new "Goldilocks zone"

The E3SR journey: how e-commerce matured across Southeast Asia

Southeast Asia’s e-commerce development can be broken down into five key phases. Think of it as E3SR:

- Early (2012 to 2015):

This stage marked the beginning. Players like Lazada and Shopee entered the market, with Shopee going mobile-first from the start. Platforms were still defining their value and building user trust.

- Steady growth (2015 to 2019):

From here, online retail scaled up. The region’s e-commerce market grew by over 45 percent annually, hitting nearly US$50 billion by 2019. This phase was defined by growing seller participation, improving logistics, and rising consumer adoption.

- Sudden growth (2020 to 2022):

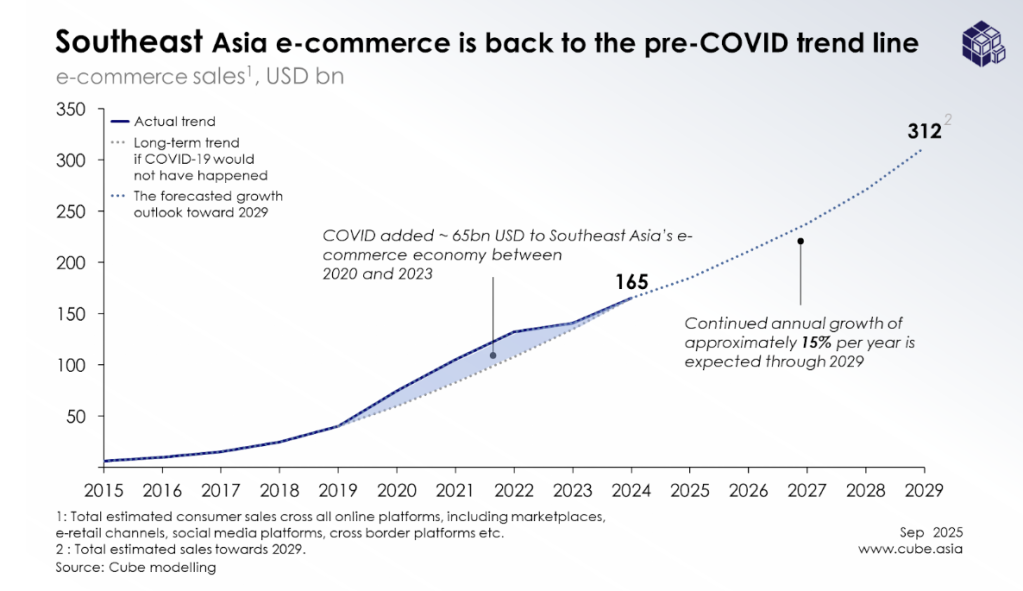

COVID-19 pushed the market into overdrive. With lockdowns in place, e-commerce spiked well beyond forecasts. Online sales added an extra US$65 billion in value between 2019 and 2024. Both new customers and long-time users deepened their reliance on digital shopping.

- Slowed growth (late 2022 into 2023):

Once restrictions lifted and offline retail returned, the pace of e-commerce cooled. Annual growth rates dropped into the single digits. Many sellers were caught off guard, facing fierce competition with shrinking margins.

- Recovery growth (2024 and 2025):

Now, the market is showing signs of sustainable growth. According to Cube’s Pulse Report, Southeast Asia’s e-commerce grew nearly 15 percent in 2024. While not explosive, this figure still represents meaningful absolute growth.

What recovery growth looks like today

Despite slower momentum, online channels remain far from saturated. E-commerce accounts for only about 30%-35% of total consumer spending in the region, excluding large-ticket items like homes and vehicles. The majority of purchasing still happens offline, meaning the digital share has room to grow.

Online shopping is no longer a novel habit. It is a normalized behavior across demographics and income levels. That shift signals a new era for the industry. Growth will likely hover around 15 percent annually in the short term. But sustaining that pace beyond 2030 will require more sophisticated strategies from platforms and sellers alike.

This is what Cube calls the "Goldilocks zone". Growth rates are lower than during the pandemic surge, but they are now being measured against a much larger market. That makes the dollar gains quite significant.

In fast-moving categories like FMCG, e-commerce is now driving the majority of net growth. For these companies, digital retail has become the most important battleground for gaining incremental market share.

How sellers can win in the new "Goldilocks zone"

A slower growth rate does not mean shrinking opportunities. It means the competition is tighter, and execution matters more. Sellers who adapt to this new normal can still outperform.

Here are some actionable tactics that Cube highlights for brands selling online today:

1. Target underpenetrated or fast-growing categories

Look beyond the top-performing SKUs and find where your category is underserved. New verticals and tier-two cities are often overlooked but rich in potential.

2. Participate in platform-wide sales events

Sales campaigns still drive volume. Events like 11.11, Ramadan Mega Sales, or platform anniversary days give sellers access to algorithm boosts, homepage placements, and increased traffic.

3. Expand across marketplaces

Many sellers rely too heavily on one or two platforms. Diversifying your presence helps reduce risk and opens new growth channels. Some platforms are also gaining traction in specific geographies or product categories.

4. Optimize product pages and review volume

Good content sells. High-quality images, local-language descriptions, and verified reviews can lift conversion significantly. The difference between a 3.8-star and 4.2-star average rating is often worth thousands of dollars in sales per month.

The next phase still favors the agile

Southeast Asia’s e-commerce market may be past its hypergrowth chapter, but that does not mean it is stagnating. This is a maturing ecosystem with more competition and higher stakes.

Sellers who treat 15 percent growth as a ceiling are missing the point. This figure, layered on top of a US$100 billion base, signals immense volume. Winning in this market now means adapting faster, selling smarter, and staying plugged into evolving platform features.

The next wave of winners will not be the biggest spenders. They will be the most adaptive.