Why Southeast Asia's e-commerce future hinges on trust and authenticity

Lazada and Cube reveal how trust-first platforms are rewriting e-commerce playbooks

A new report from Cube and Lazada outlines a significant shift in Southeast Asia’s e-commerce landscape.

Trust, not price, is becoming the core driver of online purchases, especially among younger, brand-conscious consumers.

This article explores how authenticity-driven e-commerce is reshaping the region’s digital retail space, the rise of Mall ecosystems like LazMall and Shopee Mall, and what marketers need to know as consumer behaviors evolve.

Short on time?

Here’s a table of contents for quick access:

- What is authenticity driven e-commerce?

- Why trust matters more than ever

- Three growth levers driving this shift

- What marketers should know

What is authenticity driven e-commerce?

According to the study, authenticity-driven e-commerce refers to the purchase of branded goods via high-trust Mall environments such as LazMall, Shopee Mall, and TikTok Shop Mall.

These are curated spaces within multi-vendor platforms that guarantee product authenticity, transparent pricing, and post-purchase support.

The concept has moved from niche to mainstream. In 2020, Mall environments made up just 12% of total e-commerce in Southeast Asia. That share is expected to hit 30% in 2025 and could climb to 55% by 2030, equivalent to around US$150 billion annually.

Why trust matters more than ever

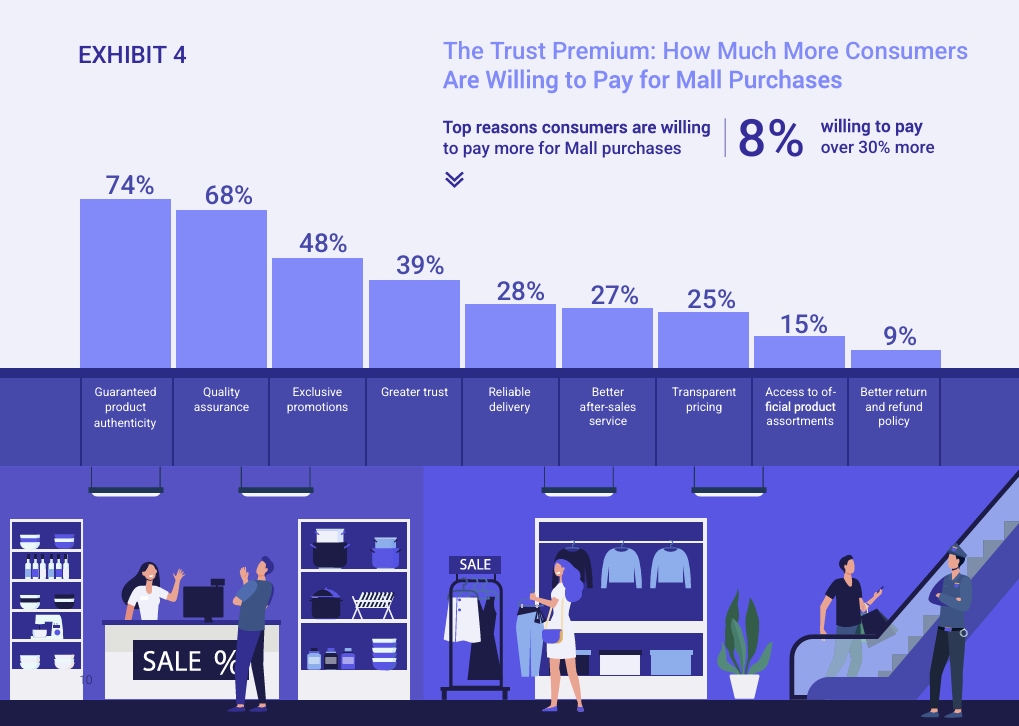

Nearly 90% of online shoppers in Southeast Asia are now active in Mall environments, citing guaranteed authenticity, better after-sales service, and consistent product quality as top reasons. The report also found that 90% of respondents are willing to pay more when buying from these environments, with 8% ready to pay over 30% extra for the trust premium.

This is not just about brand equity. It is about brand safety, especially in categories like beauty, electronics, and mother and baby, where counterfeit risks run high. For marketers, this rising demand for trusted platforms signals a shift from discount-led tactics to credibility-first positioning.

Three growth levers driving this shift

The projected rise of authenticity-driven e-commerce to 55% of Southeast Asia's online retail by 2030 is not happening by accident. According to Cube and Lazada, the next stage of growth will be powered by a combination of supply expansion, channel integration, and smarter technology. Here's how the shift is taking shape:

1. Closing the supply gap

Even with demand surging, availability remains an issue. Over 80% of online shoppers report encountering out-of-stock items, unlisted products, or inflated reseller pricing. Expanding international assortments through official channels will be critical to converting demand into long-term growth.

2. Omnichannel showrooming behavior

Despite digital maturity, Southeast Asia’s consumers still value tactile, in-store validation, especially for high-consideration purchases. Categories like beauty and electronics see over 70% of consumers researching offline before buying online. Marketers must ensure their online assets, from product visuals to descriptions, match the level of confidence shoppers get in-store.

3. AI-assisted decision-making

Generative AI is already influencing product discovery and research. Over 78% of shoppers now use tools like ChatGPT and Gemini to compare products, more than those relying on family or friends. While human recommendations still lead in trust, AI is becoming a key part of how consumers evaluate purchases.

What marketers should know

This shift is not a trend. It is a redefinition of how e-commerce will operate in Southeast Asia over the next five years. Here's how brands and platforms can adapt:

1. Invest in authenticity signals

Ensure your listings on marketplaces are verified and meet Mall standards. Ratings, reviews, return policies, and seller credentials all build trust.

2. Embrace showrooming as strategy

Do not treat offline touchpoints as competition. Use them to build buyer confidence that drives conversion online. This is crucial for tactile or safety-driven categories.

3. Align with AI-driven discovery

Make your content AI-readable and comparison-friendly. Invest in structured data and clear benefit messaging that performs well in conversational interfaces, not just SEO.

4. Upgrade logistics for premium experience

Mall-driven growth will demand better delivery, returns, and warranty support. If you sell premium products, think of logistics as an extension of your brand.

As Southeast Asia’s digital economy matures, authenticity is becoming the new currency of e-commerce. Mall ecosystems offer the structure and safeguards needed to meet rising consumer expectations, and they are quickly becoming the dominant model.

For marketers, this means shifting focus from promos and pricing to trust, transparency, and post-purchase experience. Those who lead on credibility will win the next phase of growth.