The rise of microdrama apps

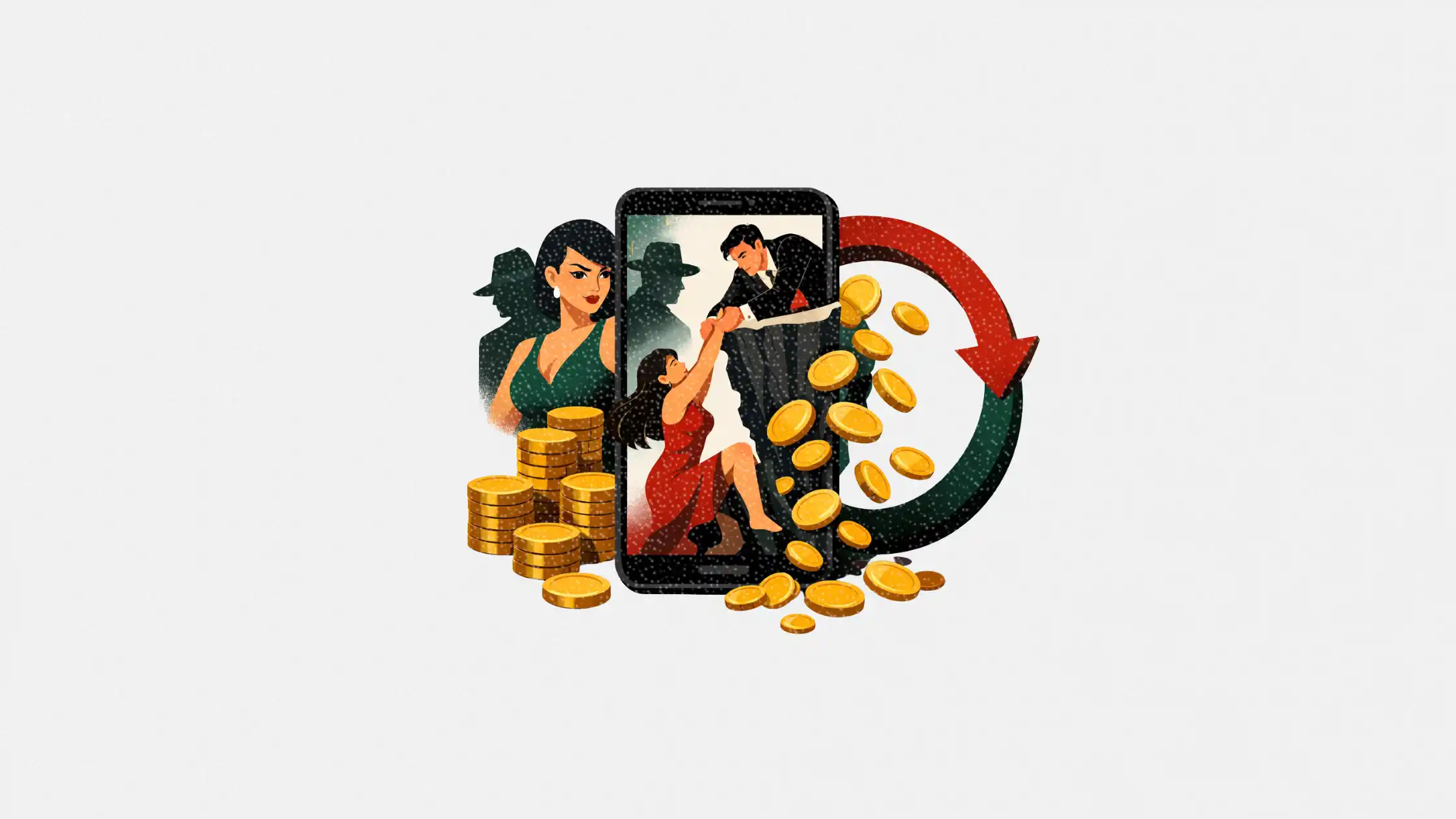

Microdrama apps are exploding in popularity, and marketers should pay attention to how they’re monetizing engagement

Short, pulpy, and endlessly addictive, microdramas are turning mobile storytelling into a multi-billion-dollar industry. While they might look like overacted TikTok videos, these one-minute dramas are pulling in serious cash—and marketers should be paying attention.

In China alone, revenue from microdramas hit US$6.9 billion in 2024, according to Shenzhen-based research firm DataEye. For the first time, that figure surpassed the country’s domestic box office. Outside China, short-drama apps brought in another US$1.2 billion, with 60% of that revenue coming from the U.S., according to Sensor Tower.

This article explores the business model driving these apps, why audiences are hooked, and what lessons marketers can draw from the rise of “junk TV” that sells.

Short on time?

Here’s a table of contents for quick access:

- What’s behind the microdrama surge

- Why Quibi failed but ReelShort wins

- The gamified business model fueling billions

- What marketers should know

What's behind the microdrama surge

Microdramas first took off in China, and now the format is having its breakout moment in the US. The formula is addictive: minute-long vertical videos with relentless cliffhangers and over-the-top storytelling. The themes are pulp-heavy, with titles like “My Sister Is the Warlord Queen” and “In Love with a Single Farmer-Daddy.”

Big tech and Hollywood are getting involved. TikTok launched PineDrama, a standalone microdrama app, while a new app called GammaTime just raised US$14 million. Its backers include Alexis Ohanian, Kim Kardashian, and Kris Jenner.

Why Quibi failed but ReelShort wins

It’s hard not to think of Quibi. The short-form streaming startup launched with Hollywood stars and US$1.75 billion in funding but flopped hard. The idea was 10-minute premium episodes for on-the-go viewing. Nobody bit.

ReelShort and its peers took the opposite route. Instead of high-production value, they lean into trashy, serialized entertainment that thrives on formula. As Eric Wei, CEO of Karat Financial, put it, “They’re basically OnlyFans for the female gaze. This is like ‘50 Shades of Grey’ for vertical video.”

They’re not aiming for Emmys. They’re aiming for dopamine.

The gamified business model fueling billions

These apps borrow tactics from mobile gaming. Users get hooked on free episodes and are rewarded with in-app currency for logging in. Eventually, you hit a paywall. Want to see the main character confront her cheating fiancé? That’ll cost tokens, or you can watch an ad, or just pay US$20 a week to skip the hassle.

Sometimes users are given choices. Help the protagonist stand up to her abusive ex? That option costs tokens. Let him off the hook? That one’s free.

The model is engineered to keep viewers in a loop of spending, with ambiguous currency systems that obscure the real-world costs.

AI is only accelerating this trend. Platforms like PocketFM are already using AI tools like CoPilot to help creators build more addictive story arcs. Ukrainian studio Holywater, behind the app My Drama, brands itself as an “AI-first entertainment network.”

With AI, studios can pump out more content at lower costs, perfectly tuned to hit the emotional beats that keep users coming back (and paying).

What marketers should know

Marketers, especially those in media, content, or entertainment, should take a hard look at the playbook behind these apps.

1. Low-fi content can still mean high ROI

These apps prove that quality is not always king. What matters more is volume, structure, and emotional pacing. If your content hits the right pain or pleasure points, people will watch. And pay.

2. AI-driven storytelling is becoming scalable

Generative tools aren’t writing prestige dramas, but they can absolutely churn out microdrama scripts. The same principle could apply to your branded content or engagement campaigns.

3. New storytelling formats are emerging

Microdramas are basically gamified soap operas in vertical format. This opens up possibilities for interactive branded storytelling, product placement in episodic content, or new ad formats that reward attention rather than interrupt it.

4. Consider behavior, not just content type

This trend is more about how people engage than what they watch. Marketers need to think beyond platforms and start designing for user patterns like bingeing, tapping, and token-spending.

Microdrama apps may not win awards, but they’re dominating screen time and user wallets. That alone makes them worth studying.