Netflix retakes #1 in US streaming, but 2025 was a year of losses

Netflix is back on top, but Prime Video, Paramount+, and HBO Max all lost ground in 2025

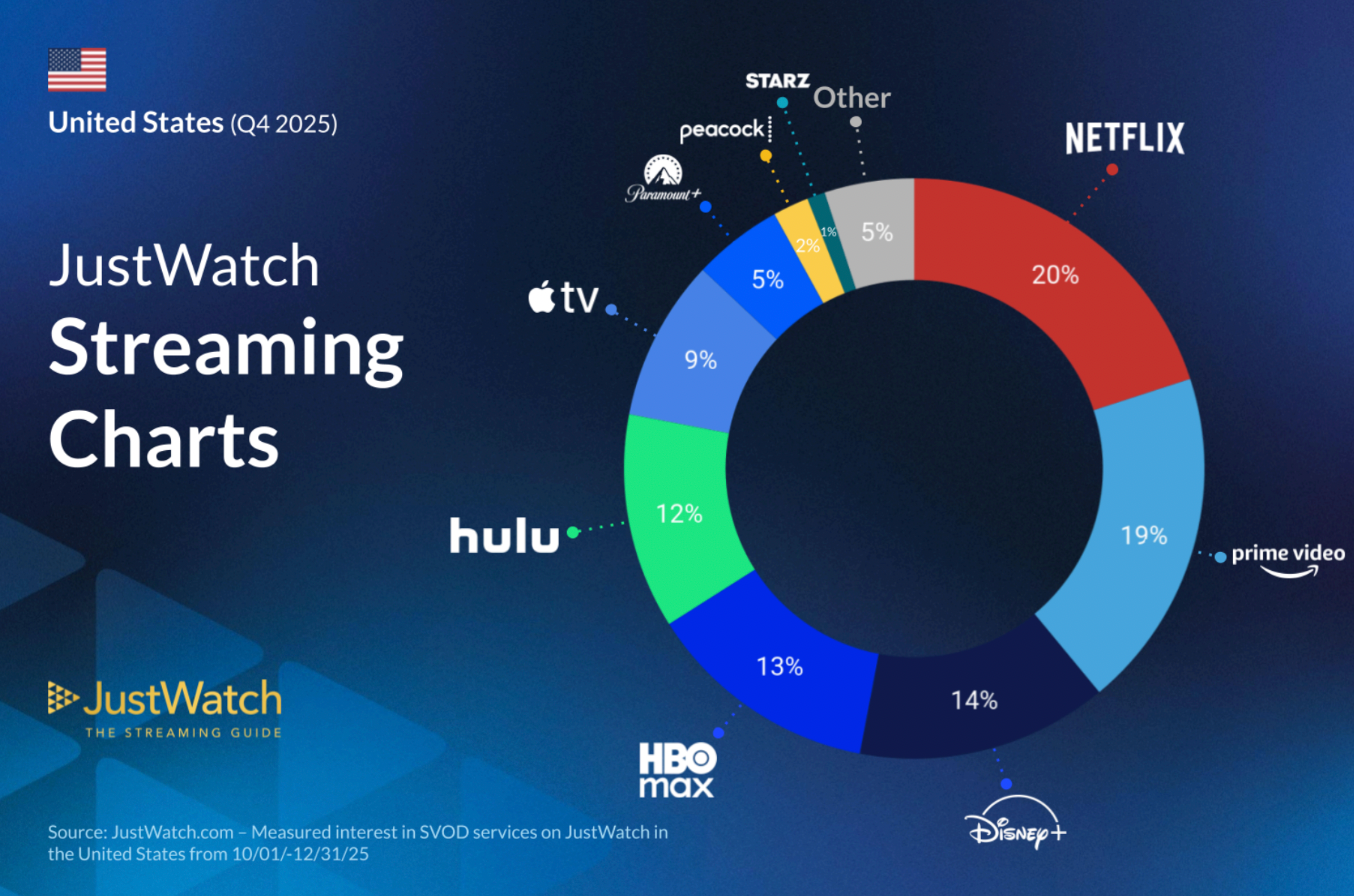

Netflix finished 2025 with a win, reclaiming the top spot in US streaming market share by edging out Amazon’s Prime Video. But the bigger story isn’t who’s first. It’s that both leaders lost ground over the year while the middle tier surged forward.

This article explores the Q4 2025 US SVOD market share data released by JustWatch, highlighting where the major streamers stand, who gained momentum, and what the shifts reveal about audience behavior and platform risk in a crowded streaming market.

Short on time?

Here’s a table of contents for quick access:

- Netflix beats Prime Video in Q4 but both lost share in 2025

- Disney+ and Apple TV+ emerge as biggest gainers

- Paramount+ and Prime Video had the steepest declines

- What marketers should know

Netflix beats Prime Video in Q4 but both lost share in 2025

According to JustWatch, Netflix closed Q4 2025 with a 20% US market share, narrowly ahead of Prime Video at 19%. This marks a 1 percentage point quarterly gain for Netflix and a 1-point loss for Prime Video, solidifying the leadership shuffle in the final stretch of the year.

However, the annual story tells a different tale. Netflix dropped 1 point year-over-year, while Prime Video shed 3. Despite still leading the pack, both platforms are gradually losing share to smaller, more focused services.

Netflix retained high engagement throughout the year with hits like Stranger Things and Frankenstein topping the JustWatch U.S. Streaming Charts. But exclusives alone may no longer be enough to preserve dominance as content fatigue and user churn intensify.

Disney+ and Apple TV+ emerge as biggest gainers

Disney+ surged to 14% market share by Q4, gaining 2 points year-over-year and overtaking HBO Max to become the third-largest US streaming platform. Apple TV+ also saw a strong 2-point annual rise, finishing 2025 with 9%.

Both platforms benefited from a blend of exclusive originals and major IP. Disney’s strength came from Alien: Earth, Andor, and theatrical titles like Zootopia 2. Apple TV+ saw success with Severance and Pluribus, growing its reputation for prestige content.

Marketers should take note. These platforms are no longer niche. They are where mainstream viewers are going.

Paramount+ and Prime Video had the steepest declines

Paramount+ saw the sharpest drop among major services, losing 4 percentage points over the year and ending 2025 with just 5% of the market. While it had some notable titles such as South Park, MobLand, and The Naked Gun, the post-Yellowstone era left a gap the platform didn’t fully recover from.

HBO Max held steady at 13% but lost its top-three spot to Disney+ earlier in the year. Prime Video’s 3-point annual decline reflects a broader trend of viewer fatigue with generalist platforms.

Even Hulu, with more modest growth, managed to outpace HBO Max in Q4 engagement, ending at 12%.

What marketers should know

For marketers planning OTT campaigns or streaming partnerships, the JustWatch data offers clear signals. The US streaming market is no longer top-heavy. It’s fragmenting.

Here are four takeaways:

1. Platform loyalty is fading

Even Netflix is vulnerable to churn. Brand affinity matters less than content freshness, which means marketers should monitor release cycles and promotional windows more closely.

2. Mid-tier streamers are gaining power

Disney+ and Apple TV+ are no longer fringe players. They offer increasingly mainstream audiences, making them strong candidates for brand placements, co-marketing, or CTV ad buys.

3. Content timing now drives performance

Engagement spikes around specific titles. Netflix’s Q4 gain was tied to Stranger Things, while Disney+ rode the momentum of Andor and Zootopia 2. Marketers need to time campaigns around these cycles.

4. Niche platforms are pulling viewers

“Other” platforms collectively gained 2 points in 2025. While each holds small market share, their dedicated audiences can offer value for targeted or B2B brand activations.

The US streaming market in 2025 was less about who’s number one and more about how fast the ground is shifting. Netflix may be back on top, but all signs point to a fractured future where audience loyalty is fleeting and mid-tier platforms hold more sway.

For marketers, this means adapting fast. Follow the content, not just the platform. Diversify your media spend. And watch the long tail closely. That’s where the growth is going.