Why luxury marketers should watch Hong Kong and Singapore this Golden Week

A new MDRi survey reveals how ultra-rich Chinese travelers are spending during Golden Week 2025

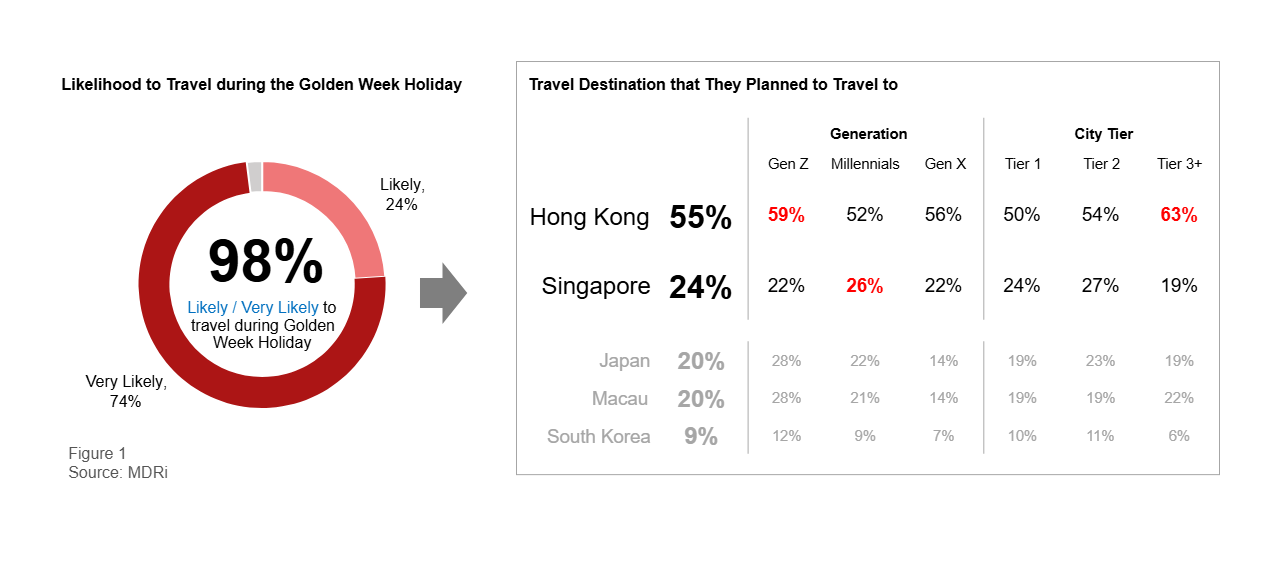

Golden Week 2025 is becoming a key growth engine for Asia’s luxury and hospitality industries, driven by affluent travelers from Mainland China. According to a recent survey by MDRi, 98% of respondents, each with liquid assets exceeding RMB 7 million, plan to travel during the national holiday. Hong Kong and Singapore are emerging as the top destinations.

As this high-spending segment mobilizes, luxury retailers, hoteliers, and destination marketers across Asia are being handed a clear signal. Elite Chinese travelers are not just returning. They’re ready to splurge.

This article explores key findings from MDRi’s study, what they mean for marketers, and how brands in the region can respond.

Short on time?

Here’s a table of contents for quick access:

- Where affluent Chinese are traveling for Golden Week

- How much they’re spending and why it matters

- What marketers should know: retail, hospitality, and cultural signals

- Generation-based insights for targeted strategy

Where affluent Chinese are traveling for Golden Week

The MDRi survey reveals that Hong Kong leads the pack, with 55% of respondents selecting it as their primary destination. Singapore follows at 24%, while Japan (20%), Macau (20%), and South Korea (9%) round out the list.

Interestingly, 16% of Hong Kong-bound travelers also plan to include Macau as part of their trip. Gen Z shows the strongest interest in this dual-destination experience. This trend suggests a growing appetite for short-haul regional travel anchored in luxury, convenience, and cultural familiarity.

How much they're spending and why it matters

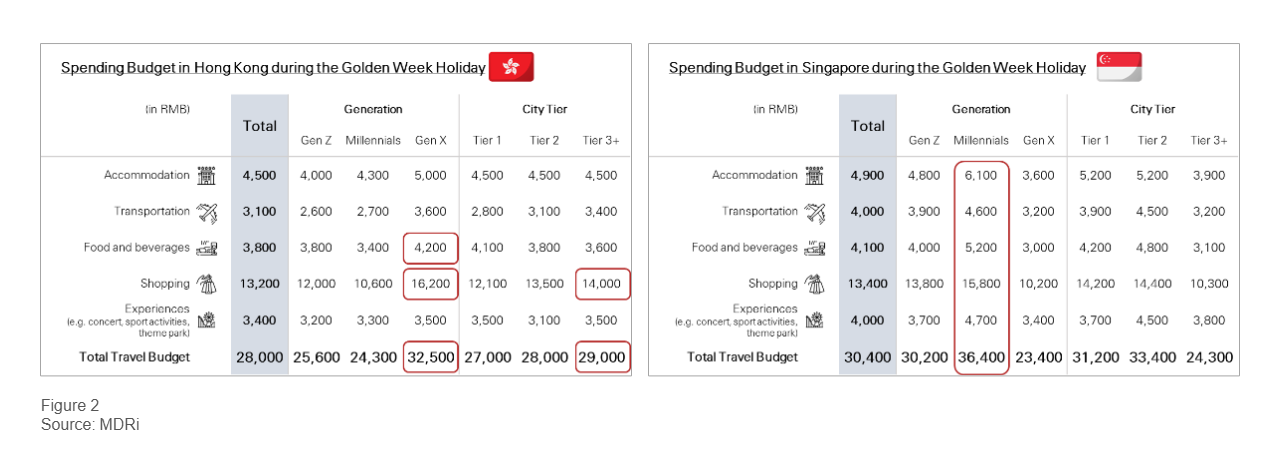

Chinese travelers aren't just visiting. They’re opening their wallets. The average planned spend is RMB 28,000 (approx. US$3,830) in Hong Kong and RMB 30,400 (approx. US$4,160) in Singapore. Gen X travelers expect to spend the most in Hong Kong (RMB 32,500), while Millennials are forecast to outspend other groups in Singapore (RMB 36,400).

Millennials are also planning the longest stays, averaging nearly five days in Singapore. These trip lengths and spending patterns underscore a demand for multi-day premium experiences, not just transactional tourism.

What marketers should know

Luxury shopping remains a major draw, with 81% of travelers to Hong Kong and 82% to Singapore planning high-end retail purchases. However, the motivations behind these purchases differ by city.

- Hong Kong is favored for its elite retail hubs like Pacific Place, IFC, and Times Square. Its culinary scene and shopping convenience are added draws. Only 1% of respondents said they hadn’t decided where to shop. This suggests strong confidence and repeat behaviors.

- Singapore draws luxury travelers through its polished hospitality, elevated hotel experiences, and a series of cultural events like the F1 race. Retail favorites include Marina Bay Sands, Mandarin Gallery, and Raffles City.

Here’s what marketers should take away:

1. Destination familiarity equals retail confidence

Hong Kong benefits from years of brand affinity and shopper familiarity. Marketers can double down on this by offering exclusive in-store experiences or VIP concierge services.

2. Hospitality is Singapore’s X factor

With Singapore carving out a distinct identity around premium hospitality, hotel brands and high-end service providers should consider integrated travel-shopping packages or culinary tie-ins.

3. Cultural calendar matters

Time your campaigns around events. Singapore’s F1 festivities and Hong Kong’s fireworks are not just spectacles. They’re conversion drivers.

Generation-based insights for targeted strategy

The data highlights that Gen Z and Gen X are skewing toward Hong Kong, while Millennials are the dominant force behind Singapore’s premium appeal. This insight can inform how marketers position their offers.

- For Hong Kong: Emphasize heritage luxury, urban convenience, and time-saving travel features. Consider digital-first campaigns that resonate with Gen Z’s appetite for blended travel-retail content.

- For Singapore: Lead with experiential messaging such as boutique hotel vibes, fine dining, and cultural exploration. Millennials are looking beyond price tags. They want memory-making value.

Notably, Hong Kong’s popularity among travelers from Tier 3 and lower-tier cities (63%) reflects the geographic broadening of China’s luxury travel base. Marketing strategies should no longer be limited to Tier 1 assumptions. There’s rising demand from deeper inside the Mainland.

MDRi’s findings offer more than just a snapshot of where affluent Chinese are going for Golden Week. They point to a deeper shift in how luxury experiences are being consumed in Asia. Hong Kong may still dominate as a luxury retail capital. Singapore is swiftly defining itself as Southeast Asia’s answer to the curated lifestyle destination.

For brands that serve high-net-worth travelers, this is a call to adapt fast. Whether you're running a regional campaign or a local storefront, aligning with this segment’s evolving behaviors could unlock big gains this Golden Week and beyond.