UK media attention is plateauing according to McKinsey study

UK media consumption isn’t slowing, but attention is. Here’s how marketers can recalibrate

UK consumers still spend hours a day with content, but McKinsey’s latest study reveals a bigger issue: much of that time isn’t translating into revenue.

Across mediums, from social video to live events, there’s a growing divide between time spent and money earned. The UK media landscape is increasingly fragmented, and traditional metrics like reach and impressions no longer tell the whole story. Instead, McKinsey argues that quality of attention, defined by focus and intent, is the key to unlocking true media value.

This article explores key insights from McKinsey’s December 2025 report, Mind the Attention Gap, and what marketers need to rethink in a saturated media environment.

Short on time?

Here’s a table of contents for quick access:

- The attention equation: not all engagement is created equal

- Where UK attention is going

- Live events monetise, digital media lags

- What marketers should know

The attention equation

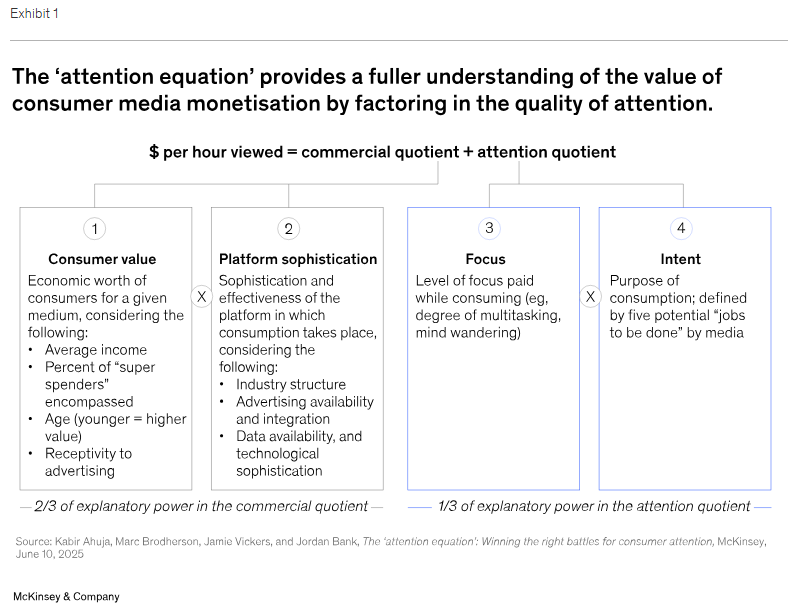

McKinsey introduces the “attention equation,” which measures not just how long people spend with media, but how focused they are and why they’re consuming it. These two factors, focus and intent, combine to form what McKinsey calls the attention quotient.

Media that commands high-quality attention (think live sports or books) tends to generate far more revenue per hour than those with low focus and passive consumption (like background radio or autoplay social video). In fact, McKinsey finds that attention explains one-third of the variation in monetisation outcomes across media types.

For marketers, this means that not all impressions are equal. A short-form video view while multitasking doesn’t hold the same value as a viewer deeply engaged with long-form content.

Where UK attention is going

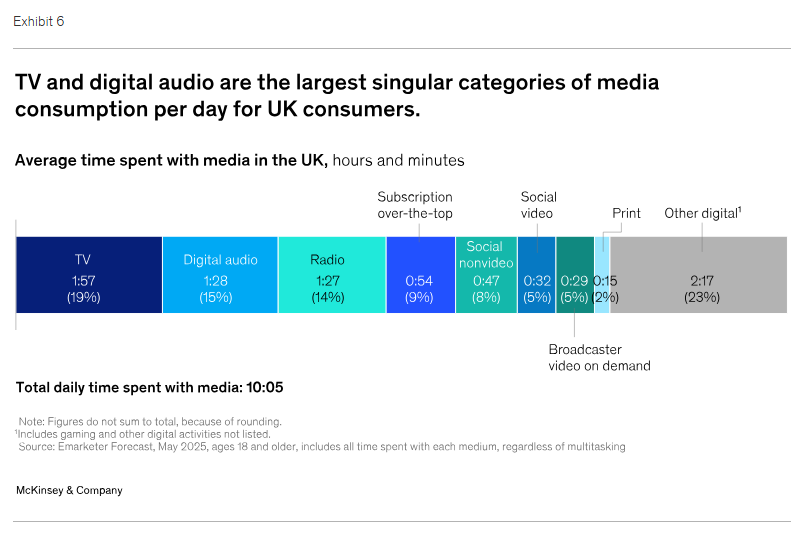

While UK media consumption surged during the pandemic, reaching over 10 hours per day in 2020, it has since plateaued. This slowdown comes despite a continued increase in content volume and access points, particularly across digital channels.

Today, UK consumers split their attention across more formats and devices than ever. Digital media now accounts for 65% of total media time, while user-generated content has grown from 16% of consumption in 2018 to 27% in 2024.

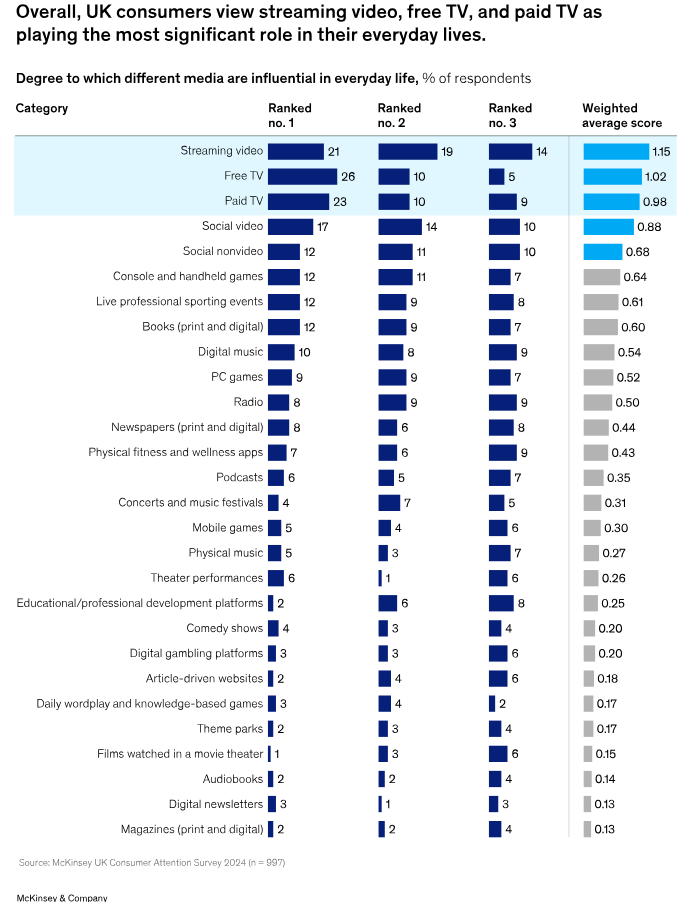

Despite the buzz around short-form video, the most influential formats in the UK remain streaming video, free-to-air TV, and paid TV. These formats lead across multiple metrics—from daily time spent to emotional attachment and perceived importance in consumers’ lives.

Key stats:

- TV leads time spent: UK consumers spend an average of 1 hour and 57 minutes per day watching TV, making it the top media category for daily engagement.

- Streaming is the most valued: 15% of consumers say they’d be most upset if streaming video were removed from their lives, ranking it ahead of any other medium.

- Social video isn’t far behind: 13% say social video is their most valued media type, reflecting its emotional pull even if monetisation still lags behind more established formats.

For marketers, this reaffirms the central role of video—particularly long-form and appointment-based viewing—in both brand building and performance. Streaming and premium TV placements continue to offer strong resonance and a platform for immersive storytelling.

Live events monetise, digital media lags

McKinsey’s analysis shows that live experiences such as sports, concerts, and amusement parks are among the most efficient at converting attention into revenue. They command high focus, clear intent ("I want to enjoy something I love"), and are priced accordingly. For example, live sports generate 1,400 times the revenue per hour compared to podcasts.

On the flip side, audio streaming accounts for 28% of content consumption but only 5% of media revenue. Even as consumers shift to digital, monetisation hasn’t kept pace. This creates a mismatch: hours are growing in some arenas, but the dollars aren’t following.

Interestingly, streaming video platforms that deliver focused, purposeful viewing tend to extract greater lifetime value from subscribers. Platforms that cater to niche or live content, like sports-focused streamers, outperform generalists in attention quality and monetisation.

What marketers should know

Marketers operating in the UK media ecosystem should treat attention like a performance lever, not just a diagnostic. Here’s how:

1. Rethink media mix based on attention quality

Shift away from purely reach-based decisions. Prioritise formats and platforms that offer high focus and clear intent, even if they attract smaller audiences. Live and niche content, educational podcasts, and long-form video may offer higher ROI per hour.

2. Layer attention metrics into segmentation

Incorporate focus and intent data into campaign planning. Not all digital video is equal. Ads shown during “lean-in” moments on streaming platforms may outperform autoplay formats on social media.

3. Explore underpriced attention

Some media formats may be undermonetised relative to the quality of engagement they deliver. Retail media and certain streaming video formats may still offer value arbitrage for savvy advertisers.

4. Prepare for platform churn

Even platforms with high attention quality, such as sports streamers, face churn risks due to high pricing or seasonal subscriptions. Build adaptive campaigns that flex across changing consumption patterns.

McKinsey’s report confirms what many marketers have sensed: attention is the real currency in media, and UK consumers aren’t spending it evenly. By embracing metrics that go beyond impressions and watch time, brands can make smarter choices that reflect how people actually engage.

Now’s the time to rebalance your media strategy, not around volume, but around value.