Key martech startup news: 175+ investments and acquisitions in 2021

With a global market size of US$121.5 billion, investors and marketers should check out the latest martech startup funding news here.

The global marketing technology (martech) sector has reached US$121.5 billion in value and continues to grow. Marketers and investors who want to keep an eye out for new product ideas and trends should make a habit of staying up-to-date on the latest martech investments and acquisitions.

We’ve scoured the web to bring you a compilation of back-dated investment news in this particular space. The list features deals that took place between January and December of 2021.

Feel free to bookmark this post, as we will continuously update it with new deals and info regularly.

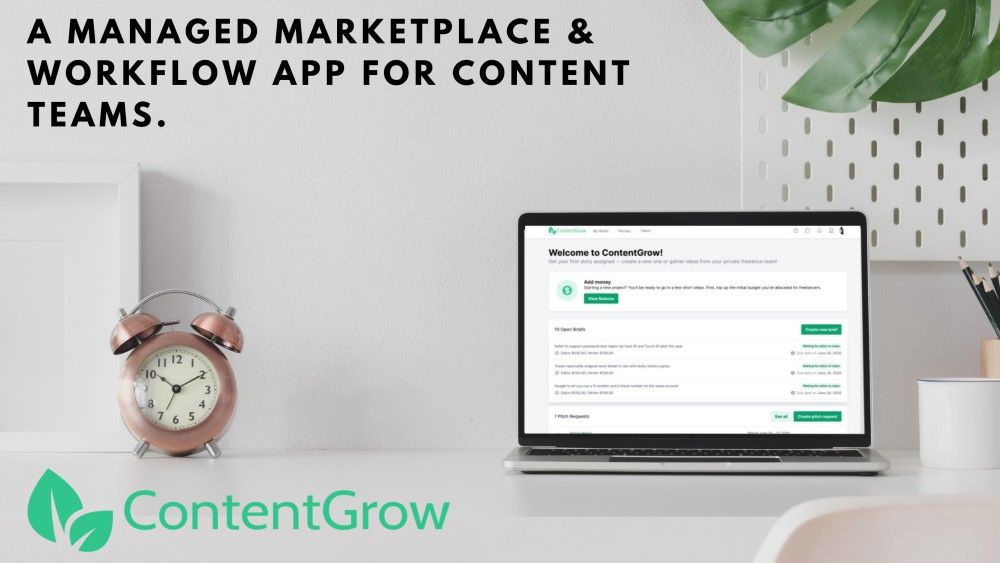

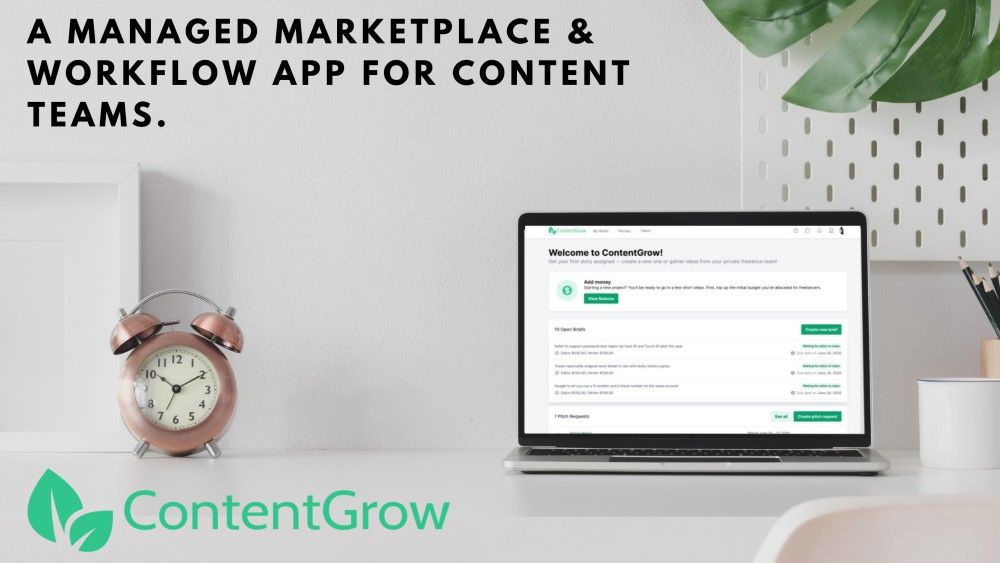

If you’d like us to feature your martech funding or deal news, please send a press release to info@contentgrow.com

|

Martech startup funding news in 2021

|

Martech startup funding news - December 2021

Salesloft

Atlanta-based sales engagement platform Salesloft announced an investment of an undisclosed amount from Vista Equity Partners. The round puts Salesloft at a US$2.3 billion valuation.

Prior to this round, Salesloft had raised a total of US$245.7 million in funding. The company provides a platform for sellers and sales teams to execute personalized campaigns and automate them depending on their customer’s purchase behavior.

Adventr

NY-based video communications platform Adventr raised a US$5 million seed round led by Paladin Capital, with participation from Reinventure Capital, Invisible Ventures, and musician John Legend.

Adventr provides a drag-and-drop editor where creators can add interactive elements to their videos to increase user engagement. The firm says that it now has over 8,000 beta users, including AsiaNet News, MSI gaming, SK Interactive, and The New South Wales Government. The martech firm has raised a total of US$6 million from two rounds.

Mperativ

San Francisco-based revenue marketing platform Mperativ closed a US$5 million series A round led by GFT Ventures along with Heroic Ventures and Westwave Capital. This brings the martech app’s funding size to US$6 million.

The platform helps marketers and sales teams prepare easy-to-digest sales and marketing analytics, so they can focus on their jobs rather than compiling and customizing reports.

Carats & Cake

The NY-based wedding marketplace Carats & Cake announced US$19.3 million in seed funding led by Acrew Capital and Founders Fund. Founded in 2013, Carats & Cake helps venues and property groups with a wide array of solutions, including marketing and client discovery.

Mavrck

Boston-based influencer marketing platform Mavrck closed a US$120 million investment round led by Summit Partners. This is a big funding leap compared to the martech firm’s previous round of US$5.8 million in 2018. Mavrck has raised a total of US$141.4 million over 11 rounds.

Mavrck helps marketers execute end-to-end influencer marketing campaigns. Founded in 2014, the company claims to have provided its services to 5,000 marketing professionals from more than 500 global consumer brands.

Rebuy

Minneapolis-based Rebuy raised US$4.4 million from Peterson Ventures and Sixekick Partners.

Founded in 2017, Rebuy allows brands on Shopify to offer personalized shopping experiences, promote product discovery, and retain more customers. The company claims to power on-site personalization for over 2,700 Shopify merchants today including Primal Kitchen, Fanjoy, Something Navy, and Magic Spoon.

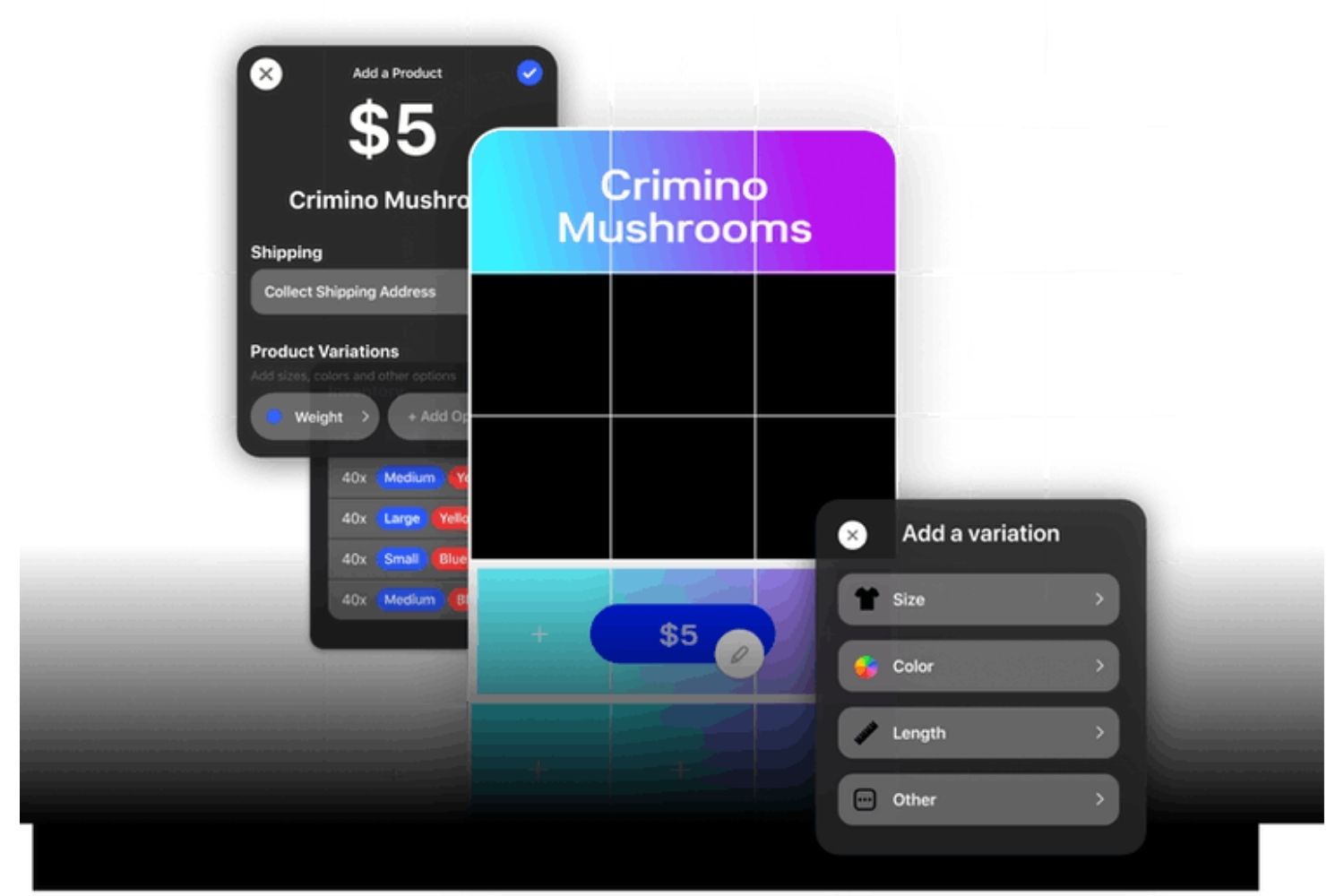

Universe

Mobile website builder Universe raised a US$30 million series B funding round led by Addition, with participation from existing investors Google Ventures, Javelin Venture Partners, Box Group, and others. This round brings the firm’s total disclosed funding to US$47.3 million.

Universe helps website creators build websites through mobile phones and grow their audiences and business via the app’s GRID system. The company mentioned that it is currently supporting more than 500,000 users.

Fable

NY-based Fable announced the launch of its platform along with a US$15 million series A investment led by Redpoint Ventures. Participating investors included Collaborative Fund, SIP Global Partners, Harrison Metal, Third Kind Venture Capital, and LightShed Ventures.

Fable’s design platform allows content creators to produce stories with motion and helps simplify managing, creating, and reviewing projects.

Genesys

The San Francisco-based cloud customer experience startup Genesys collected US$580 million in funding in a round led by Salesforce Ventures with participation from ServiceNow Ventures and Zoom Video Communications. The decacorn has raised a total of US$1.5 billion across four funding rounds and has reached a US$21 billion valuation.

The company provides a platform that allows businesses to design omnichannel client management strategies. So far, the company has accommodated 7,000 clients worldwide, including 17 of the top 20 Fortune 500 businesses.

TextUs

Denver-based enterprise texting solution TextUs landed US$22 million in a series C round led by Eastside Partners with participation from Access Venture Partners. TextUs has raised an overall total of US$32.3 million across six rounds.

The app provides businesses and sales teams a platform to increase customer engagement via real-time conversations. It also integrates with existing customer relationship management tools and offers use cases for other departments (e.g. human resources, customer support, etc).

Martech startup funding news - November 2021

SpotHopper

Restaurant marketing and operations technology provider SpotHopper received US$14 million in series A funding led by San Diego-based growth equity firm TVC Capital.

SpotHopper helps independent restaurant owners increase business exposure, attract more customers, and offer online ordering services, among others. The martech firm claims to be able to boost restaurants' revenue by 70% at a fraction of the usual outsourcing costs.

Fourthwall

Santa Monica-based website builder Fourthwall raised US$17 million in funding from a group of investors including Lightspeed, Alexis Ohanian’s Seven Seven Six, Shrug Capital, Worklife, Initialized, Defy, Todd & Rahul, and Ian Borthwick.

The startup helps digital creators convert their personal brands into businesses. With Fourthwall, creators can build websites that offer merchandise sales, memberships, and other tools to engage supporters.

Anyword

Anyword raised US$21 million in series B funding led by Innovation Endeavors, with participation from Lead Capital and Gandyr Ventures. This brings the startup’s total investment size to US$30.1 million.

The NY-based startup is a natural language generation platform that aims to help marketers create amazing copy with AI. Anyword claimed to have acquired 1,200 customers at the end of the first quarter of 2021.

Mediafly

Chicago-based sales enablement and content management technology platform Mediafly secured US$10 million in growth capital from industry insiders. This brings the company’s total disclosed funding size to US$59.7 million.

Mediafly’s tech enables marketers and sellers to attract buyers with customized and interactive content. The app also provides data insights to help users monitor sales and promote better customer relationships.

Netomi

San Mateo-based AI customer service platform Netomi closed US$30 million in series B financing led by WndrCo with the participation of existing investors Eldridge and Fin Venture Capital. This latest round puts the startup’s total funding at US$52 million.

Netomi's AI chatbot cuts down customer support resolution time by replying to customer inquiries automatically.

Luxury Presence

Real-estate marketing platform Luxury Presence raised a US$25.9 million series B round led by Bessemer Venture Partners, with participation from Toba Capital and Switch Ventures. This brings the startup’s total funding size to US$31.3 million.

The US-based Luxury Presence provides websites, marketing tools, and software to help real estate agents grow their businesses. Agents can manage their websites and digital appearance. Launched in 2016, the company claims to have served 3,500 clients, worked with more than 20 of the Wall Street Journal’s top 100 agents, and partnered with five national brokerages.

Conductor

NY-based content intelligence platform Conductor raised a US$150 million funding round led by Bregal Sagemount with participation from other undisclosed investors. This brought the firm’s total funding amount to US$210.6 million.

The martech firm offers insights to help marketers win in SEO. With Conductor, users will receive SEO recommendations such as keywords and titles. The app also provides advice on optimizing site health, among other things.

Writer

Writer closed a US$21 million series A round led by Insight Partners, with participation from Gradient Ventures, the Todd & Rahul Angel Fund, Scott Belsky, Alex McCaw, Jack Altman, Julia Lipton, Allison Pickens, Oliver Jay, Packy McCormick, Lenny Rachitsky, Austin Rief, Ankur Nagpal, Camille Ricketts, Vivek Sodera, and James Beshara.

Writer helps marketers with organizing and formatting content, increasing customer outreach, and helping with tasks such as pricing, customer service analytics, and providing a clearer, consistent marketing copy. The tool can also be used to set editorial formats (e.g. rules for punctuation, capitalization, etc).

Lusha

NY-based Lusha secured a US$205 million series B funding round led by PSG, with participation from ION Crossover Partners. This brought the firm’s total valuation to US$1.5 billion with a grand total of US$245 in raised capital.

Lusha helps sales professionals identify and gain accurate data of their potential buyers. The firm claims that it has served 800,000 salespeople and 273,000 organizations, including Facebook, Google, Dropbox, and Uber.

OpenWeb

Social engagement platform OpenWeb secured a US$150 million series E funding round led by Insight Partners and Georgian Partners, with participation from Omer Cygler, Harel, and Entrée Capital. The company’s first strategic investors also participated in the round, including The New York Times Company, Dentsu and Samsung Next, as well as individual investor Professor Scott Galloway. The round brings the firm’s total valuation to US$1 billion.

The NY-based OpenWeb helps publishers manage user comments and strengthen relationships with their audiences. With the app, publishers can facilitate real-time discussions and launch polls on its comments, among other things. The martech firm claims to be working with more than 1,000 publishers including HuffPost, Refinery29, and IGN.

Threekit

Chicago-based 3D visual commerce platform Threekit closed a US$35 million series B funding deal. The round was led by Leaders Fund with participation from existing investors Salesforce and Shasta Ventures, as well as strategic investors ServiceNow and Capgemini. This brought the martech company's total funding amount to US$65 million.

Threekit helps businesses and brands increase user engagement via 3D product visuals. Inside the app, businesses can create three types of images: 3D, augmented reality, and virtual photography.

Reprise

Boston-based Reprise raised a US$62 million series B funding round led by ICONIQ Growth, with participation from existing investors including Bain Capital Ventures, Accomplice VC, and Glasswing Ventures. Additionally, the round also included participation from The Daily Show's Trevor Noah and Jeffrey Katzenberg.

The product experience platform Reprise enables sales and marketing teams to build online interactive product demos without having to rely on the engineering team.

Apollo.io

San Francisco-based Apollo.io secured US$32 million in series B funding from Tribe Capital, with participation from NewView Capital. Existing investor Nexus Venture Partners also participated in the round. The martech startup has raised a total of US$41.3 million in funding.

Apollo.io is a sales and engagement platform that helps companies discover and engage with ideal and potential customers, get LinkedIn contacts, and automate tasks like emailing and updating their CRMs.

Martech startup funding news - October 2021

Influ2

NY-based marketing platform Influ2 raised an US$8 million series A funding round led by Rally Ventures, with participation from Sprout Social’s Ryan Barretto. This brings the firm’s total disclosed funding to US$14.8 million over three rounds.

Influ2 helps companies accelerate customer engagement and brand recognition by delivering ads to target customers. It helps monitors those who see and interact with ads.

VideoAmp

LA-based VideoAmp closed a US$275 million series F funding round led by Spruce House Partnership, with participation from D1 Capital Partners, Tiger Global, EPIQ Capital Group, and Ankona Capital Partners. This round brings the firm’s total disclosed funding to US$1.4 billion.

VideoAmp is a video marketing platform that helps advertisers identify and monitor the impact of their content from different platforms.

Deep North

CA-based Deep North raised US$16.7 million in series A-1 funding co-led by both Celesta Capital and Yobi Partners. The round included participation from Conviction Investment Partners (UK). In total, the company has raised US$50.4 million across three rounds.

Brands can use Deep North’s AI to customize their marketing based on demographics. The company’s tech also offers facial characterization that can help marketer’s estimate the customer’s age.

Hubilo

The CA-based virtual events platform Hubilo bagged US$125 million series B funding led by Alkon Capital, with participation from Lightspeed Venture Partners and Balderton Capital. With this latest round, the startup’s total funding has reached US$153 million in less than 18 months.

Hubilo provides a virtual and hybrid event platform to help brands attract partners and sponsors.

Molten

Cloud-based platform Molten raised US$7 million in seed funding led by Abstract Ventures, with participation from Ashton Kutcher (actor and partner at Sound Ventures) and Michael Ovitz (co-founder at CAA and former president at The Walt Disney Company).

The startup also pulled in other high-profile individual investors such as Jack Dorsey (Twitter and Square), Bill Ackman (Pershing Square Capital Management), Kevin Yorn (leading entertainment attorney), Steffen Naumann (Axel Springer), Todd Ruppert (T. Rowe Price Global Investments), and Henry Ward (Carta). Lakestar and Valor Capital Group also participated in the round.

Molten is a platform for that helps media companies with content management and availability, file storage, and distribution through a content rights management tool. Customers can use MOLTEN’s platform to connect people, data, and processes across media organizations.

Openprise

San Mateo-based Openprise secured US$16 million in an oversubscribed series A round led by SIG Asia Investment, with participation from new investors Banyan Pacific and Citta Capital. Existing investors Alumni Venture Group and AI List were also in on the round.

Openprise is a no-code platform that lets brands automate hundreds of sales and marketing processes.

Drips

OH-based AI-powered platform Drips raised an undisclosed amount of growth capital from Blue Venture Fund.

Through human-like AI-powered SMS, scheduled calling, and voicemail messages, Drips aims to help brands drive conversations at scale during key moments in the consumer journey.

Grin

CA-based influencer marketing platform Girin secured US$110 million in series B funding led by Lone Pine Capital, with participation from BOND, Devon Levesque, The Chainsmokers, and others. Existing Investors including Imaginary Ventures also participated in the round.

Grin is a creator management platform that helps brands discover and connect with their ideal influencers. It helps manage both influencer relationships and campaigns. The startup also offers sales tracking and analytics features.

Replai

Video-based creative insights platform Replai raised a US$4.7 million seed funding round led by Hoxton, Sonae IM, Luc Capital, Sequoia, and Accel. Existing investors also participated. The deal brought the firm’s total disclosed funding to US$2.5 billion.

San Francisco-based Replai analyzes the effectiveness of a video ad and provides suggestions for improving audience engagement.

SupportLogic

San Jose-based SupportLogic raised US$50 million in series B funding led by WestBridge Capital Partners and General Catalyst, with participation from existing investors Sierra Ventures and Emergent Ventures. The startup’s total funding now sits at US$62 million.

SupportLogic uses AI to help companies upgrade their service delivery and improve customer satisfaction with real-time communication tools.

Alembic

Alembic closed a US$5.2 million funding round led by KB Partners and OCA Ventures. The round brings the startup’s total funding to US$10.9 million.

Alembic helps marketers gain valuable insights with the use of predictive forecasting, media and brand valuation, augmented analytics, correlation analysis, and more.

Recurrent Ventures

NY-based Recurrent Ventures raised US$75 million in financing led by North Equity LLC. The latest investment round brought the firm’s total funding to more than US$100 million.

Recurrent Ventures is a straightforward digital media company. Its portfolio includes 20 digital media brands across automotive, home, lifestyle, military, outdoors and science verticals, and reaches more than 60 million unique visitors each month.

mParticle

NY-based mParticle, a customer data platform, raised a US$150 million series E funding round led by Permira’s growth fund, with participation from existing investors and new backers Mark Garrett (former Adobe CFO) and Jake Bailey (New England Patriots). This latest round brought the startup’s total funding to US$272 million.

mParticle’s app aims to help brands manage data quality, enforce governance, and drive better customer interactions.

Martech startup funding news - September 2021

NTWRK

LA-based livestream shopping platform NTWRK raised US$50 million led by Growth Equity Business within Goldman Sachs Asset Management and Kering. The round included participation from LionTree Partners and Tenere Capital. Existing investors Main Street Advisors, Live Nation, Foot Locker, and others also participated in the round. This led to the company’s total funding amount reaching US$60 million.

Founded in 2018, the firm allows brands and creators to sell products and interact with their customers by telling stories behind original creations.

The Vendry

NY-based The Vendry closed a US$6.5 million seed round led by the founder of Stellation Capital Peter Boyce. Founded in 2013, the company helps event professionals source venues and vendors. The platform helps users grow their networks and gain access to helpful resources for event planning.

Pass It Down

LA-based storytelling firm Pass It Down secured nearly US$2 million in seed funding led by VentureSouth, with participation from Cultivation Capital, Techstars, Red Stick Angels, and Acadian Capital Ventures. This round brings the firm’s total disclosed funding to US$3.1 million.

Pass It Down helps brands create interactive and touchscreen online exhibits to attract customer engagement.

Postal.io

Marketing technology company Postal.io raised US$22 million in series B funding from OMERS Ventures. Existing investor Mayfield Fund also participated in the round. Postal.io has raised a total of US$31 million.

The marketing platform allows companies to personalize and scale direct mail for sales and marketing, create customized gifts to increase engagement with customers and prospects, and organize events.

Pyxis One

Pyxis One closed a US$17 million series B round co-led by Celesta Capital and PremjiInvest, with participation from existing investors Chiratae Ventures, Exfinity Ventures, and pi Ventures.

The CA-based startup offers what it calls a powerful AI blueprint to make marketing data-backed, intelligent, agile, and effortlessly scalable.

Sendoso

San Francisco-based Sendoso secured US$100 million in series C funding led by SoftBank Vision Fund 2, with participation from Craft Ventures, Felicis Ventures, Oak HC/FT, Signia Venture Partners, Stage 2 Capital, and Struck Capital.

The sending platform helps brands engage with customers throughout the buying journey. It helps with direct mail, customized gifts, and virtual experiences.

Tiled

Interactive content platform Tiled closed US$13.7 million in series A funding from Signal Peak Ventures. The round included participation from existing investors along with Seismic, Adobe, and University Growth Fund. This round brought the company’s total funding to US$17.5 million.

Tiled helps salespeople, marketers, creators, and HR teams gather and share their content.

Callin

San Francisco-based Callin raised a US$12 million series A round co-led by Sequoia Capital, Goldcrest Capital, and Craft Ventures.

The social podcasting app gives users a platform to create, discover, and use both live and recorded audio content. The app lets creators interact with live listeners and save content after the live show ends.

RedCircle

RedCircle raised US$6 million in series A funding co-led by EPIC Ventures and Refinery Ventures. This round was joined by Bloomberg Beta, Eckart Walther, George Stampolos, Justin Wohlstadter, Math Capital, and Signal Fire.

The LA-based startup is a platform for independent creators, podcasts, and brands to send their messages while managing content and growing their audiences.

Pixalate

CA-based Pixalate received US$18.1 million of additional growth capital, bringing the company’s current total funding to US$22.8 million.

The fraud protection app provides solutions to detect and eliminate fraud in advertising. The company claims to monitor five app stores and plans to add China-based stores like Tencent and Baidu soon.

Revenue Grid

Sales automation platform Revenue Grid closed US$20 million in series A funding led by W3 Capital, with participation from ICU Ventures. This brought the firm’s total amount raised US$21.5 million.

The CA-based startup supports teams by providing guidance and tools to improve sales performance.

Martech startup funding news - August 2021

Walnut

NY-based Walnut raised US$15 million in series A funding led by Eight Roads Ventures, with participation from AppsFlyer, Alibaba, Hibob, and Made.com. The round brought the firm’s total funding to US$21 million.

Walnut offers marketers a customizable sales demo platform that helps improve sales engagement.

FLIP

LA-based social commerce app Flip raised a US$28 million series A round led by Streamlined Ventures, with participation from BDMI, Mubadala Capital, and Ruby Lu. This brings the company’s total funding to US$31.8 million.

Flip’s social shopping app helps customers ‘try out’ products with photos and provides interactive video reviews.

Picsart

Picsart raised US$130 million in series C funding led by SoftBack Vision Fund 2, with participation from G Squared and Tribe Capital. Existing investors Sequoia, DCM, Graph Ventures, and Siguler Guf & Company also participated in the round. Founded in 2011, the firm’s total funding is now US$195 million.

The creative photo and video editing platform allows creators and influencers to create, reform, and share their stories with free-to-edit photos, stickers, backgrounds, and more.

Involve.ai

LA-based Involve.ai closed a US$16 million series A round led by Sapphire Ventures. Existing investors Bonfire Ventures, Greycroft, Launch Capital, and BDMI alongside new investors GTMfund, Fenwick, Gokul Rajaram, Stanford University, and Michael Whitmore also participated in the round.

The customer intelligence platform offers AI to help marketers and sales folks make better business decisions.

Breef

NY-based ad management platform Breef secured US$3.5 million in funding led by Greycroft, with participation from 640 Oxford Ventures, Helen McBrain, John McBain, Lance Armstrong, Laurence Holyoake, Rackhouse Ventures, and The House Fund. This brought the firm’s total funding to US$4.4 million.

Breef provides a platform that allows brands to connect with target agencies easier and get service on their digital and creative projects.

Metabase

SF-based startup Metabase completed a US$30 million series B funding round led by Insight Partners, with participation from Expa and New Enterprise Associates. This brings the company’s total funding to US$42.5 million.

Metabase offer data tools to help marketers measure, analyze, and share their data.

LitPic

Social network LitPic raised US$1.5 million in seed funding from a group of investors including Fritz Lanman, Kal Vepuri, Tod Sacerdoti, Adrian Aoun, Andreas Penna, Arrington XRP Capital, Coca Rocha, and Tribe Capital. The round brings LitPic’s total funding size to US$2.1 million.

LitPic aims to helps users create content, grow their audiences, and get paid, all in one app.

FICX

SF-based FICX secured US$8 million in a round co-led by NAventures and Prytek, with participation from existing investor Liberty Global Ventures. This latest round brought the startup’s total capital raised to US$16 million. The startup helps brands build digital experiences to automate any customer process.

Talkdesk

Contact center platform Talkdesk raised US$230 million in series D financing from new investor Alpha Square Group alongside the company’s existing investors Amity Ventures, Franklin Templeton, TI Platform Management, Top Tier Capital, Viking Global Investors, Whale Rock Capital, and Willoughby Capital.

The San Francisco-based platform helps companies build stronger connections with customers through AI. It claims that 1,800 companies have already partnered with Talkdesk, including Fujitsu, Trivago, IBM, and Acxicom.

People.ai

Redwood-based People.ai announced a US$100 million series D funding round co-led by Mike Dinsdale (Akkadian Ventures) and Abdulla AlBanna (Mubadala Capital). Existing investors ICONIQ Capital and Lightspeed Venture Partners also participated in the round.

The sales management platform helps teams and marketers improve sales performance by automating data processes. The platform also provides data insights to help record sales activity.

Correlated

NY-based sales solutions startup Correlated closed a US$8.3 million seed funding round co-led by Harrison Metal and NextView Ventures. The round was joined by Apollo Projects, Brian Long (co-founder at Attentive), Andrew Jones (co-founder at Attentive), Ben Darnell (Cockroach Labs), and Pete Kazanjy (Founding Sales). Correlated offers a platform with various easy-to-use sales and product tools.

Mindtickle

SF-based Mindtickle raised US$100 million in series E funding led by SoftBank Vision Fund 2. Existing investors Canaan Partners, NewView Capital, Norwest Venture Partners, and Qualcomm Ventures also joined in the round. This brought the firm’s total valuation to US$1.2 billion with a total of US$281 million in raised capital.

Mindtickle helps teams bolster sales performance with tools that identify and study customer behavior. The company claims to have several Fortune 500 and Forbes Global 2000 companies using their platform.

Yellow.ai

San Francisco-based customer experience automation platform Yellow.ai raised US$78.15 million in series C funding led by WestBridge Capital, with participation from Lightspeed Venture Partners, Salesforce Ventures, and Sapphire Ventures. This round brings the firm’s total funding to US$102.15 million.

Yellow.ai helps businesses build chatbots and voice bots to automate various functions in sales, marketing, support, and more.

Fullstory

Atlanta-based Fullstory secured US$103 million in series D funding led by Permira, with participation from Dell Technologies Capital, Glynn Capital, GV, Kleiner Perkins Caufield and Byers, Salesforce Ventures, and Stripes Group. Fullstory claims that the investment values the company at US$1.8 billion with a total of US$170 million raised.

Fullstory provides a platform that analyzes customer activity and gives brands insights on how to improve their digital experience.

Pluralytics AI

Wayzata-based platform Pluralytics AI raised US$1 million in seed funding led by Ecliptic Capital. The company claims to already have several prominent companies as customers including Speedway Motors, Nelnet Renewable Energy, and two Fortune 500 companies.

Pluralytics AI helps brands analyze content and provides recommendations on how to improve decision-making, drive engagement, and ensure brand consistency within the whole content creation process.

Martech startup funding news - July 2021

Gupshup

San Francisco-based Gupshup raised US$240 million in follow-on funding led by Tiger Global Management, with participation from Fidelity Management & Research Company, Harbor Spring Capital, Malabar Investments, and Think Investments. This increases the firm's total valuation to US$1.64 billion.

Gupshup enables better customer engagement with conversational messaging. Marketers can build conversations across marketing, sales, and support with their customers.

Kasisto

NY-based digital experience platform Kasisto closed a US$15.5 million series C funding round co-led by Naples Technology Ventures and NCR Corporation. Existing investors OAK HC/FT, Ten Coves Capital, Rho Capital Partners, Propel Venture Partners, Two Sigma Ventures, Commerce Ventures, and Partnership Fund for NYC also participated in the round. This brings the company’s total funding to US$67 million.

Kasisto offers conversational AI for banking and finance players.

Hightouch

Data software company Hightouch secured US$12.1 million in series A financing led by Amplify Partners, with participation from new investor Bain Capital Ventures and returning investors Y Combinator and Afore Capital. Angel investors Datadog, Clearbit, Okta, Segment, Materialize, Pendo, and mParticle also joined the round. This brought the firm’s total funding to US$14.2 million.

Hightouch’s platform tailors customer data and transfers it to customer relationship management, marketing, and support tools.

Orum

San Francisco-based sales automation platform Orum raised US$25 million in series A funding led by Craft Ventures. This round brings the company’s total funding to US$29 million. The firm claims to already partner with prominent companies such as Gong, Outreach, and Salesloft.

Orum uses AI to detect voicemails, filter out bad numbers, and navigate phone directories to get reps into live conversations quickly.

Tiicker

Detroit-based Tiicker closed a US$2 million pre-seed funding round from a group of venture capital players including Red Cedar Ventures and several Young Presidents' Organization members.

Founded in 2020, the app offers rewards and perks to stockholders of publicly traded companies.

Audigent

NY-based Audigent secured US$19.1 million in series B financing led by Go Philly Fund, with participation from Broadscale Group, Math Capital, Raised in Space, and RiverPark Ventures. The round brought the startup’s total capital raised to US$27.8 million.

Audigent is a data management platform that helps publishers and advertisers connect with real audiences and engage consumers with branded content.

Shopmonkey

San Jose-based Shopmonkey raised a US$75 million series C round led by previous investors Bessemer Venture Partners and Index Ventures. New investor ICONIQ Growth alongside Headline and 12BF also participated.

Shopmonkey offers an auto repair solution for businesses that helps with scheduling, messaging, reporting, billing, marketing, customer service, and more.

Pantheon

SF-based Pantheon announced US$100 million in a series E funding round from SoftBank Vision Fund 2. The firm reached unicorn status with a valuation north of US$1 billion and a total of US$200 million in raised capital.

Pantheon's platform help developers and marketers track, optimize, and maintain performance on their websites. The firm already serves numerous prominent brands such as Alaska Airlines, Brooks Running, Crocs, Lucky Brand, Patagonia, Seattle Sounders FC, and others.

Amperity

Customer data platform Amperity raised US$100 million in series D financing led by HighSage Ventures, with participation from existing investors Declaration Partners, Madera Technology Partners, Madrona Venture Group, and Tiger Global Management. With the round round, the startup raised a total of US$187 million, bringing its valuation to US$1 billion.

Amperity helps consumer brands build relationships with customers, make better strategic decisions, and improve sales outcomes.

Clientbook

Platform and mobile app Clientbook announced it has raised US$4.5 million in a round led by Aries Capital Partners, with participation from current investors Kickstart Fund and Florida Funders. In total, the startup has now raised US$6 million.

Retailers can use Clientbook to know their customers better, map the customer journey, and make the informed decisions.

OneScreen.ai

Boston-based startup OneScreen.ai closed US$1 million in pre-seed funding led by TechFarms Capital, with participation from Brian Halligan and Dharmesh Shah (co-founders at HubSpot), Wayfair’s alumni Fund, Mike Volpe (CEO at Lola.com), Todd Garland (CEO at BuySellAds.com), Kipp Bodnar (CMO at HubSpot), Jeanne Hopkins (CRO at HappyNest), and several OneScreen.ai customers.

OneScreen.ai’s platform helps marketers and content creators connect and interact with target customers. Companies can use it to manage ad campaigns.

Popshop Live

LA-based livestreaming shopping app Popshop Live raised US$100 million in series A funding led by Benchmark Capital, with participation from Access Industries, TQ Ventures, Mantis VC, and SV Angel alongside return investors Abstract Ventures and Floodgate. Individual investors Baron Davis, Hailey Bieber, Jim Lanzone, Kendall Jenner, Kevin Mayer, Michael Ovitz, Sophia Amoruso, and Vivi Nevo also joined.

Popshop Live is a mobile platform where sellers can create and host interactive shows to engage consumers and boost sales.

Arcade

Dallas-based software Arcade closed a US$4.5 million seed round led by Stage 2 Capital, with participation from ATX Ventures, Our Innovation Fund, and Rise of the Rest Seed Fund. This latest round brought the company’s total funding to US$6.5 million.

Arcade provides a gamification solution to motivate and improve the performance and retention of sales teams. The software also aims to promote better customer service and increase sales.

Martech startup funding news - June 2021

OpenExchange

Boston-based OpenExchange secured US$23 million in series D funding led by Kingfisher Investment Advisors and Stonebridge Ventures. The firm’s total funding became US$39.1 million over eight rounds.

OpenExchange connects people from different industries, provides research, events videos, life conferences, content and publications, and full-length on-demand videos.

Tenovos

NY-based Tenovos raised a US$8 million series A-1 investment led by Progress Ventures. Previous investors Bertelsmann Digital Media Investments, Dublin Capital Partners, and Revel Partners, alongside new individual investors including Jeff Lunsford (Tealium), also joined the round. The deal brought the firm’s total funding to US$12 million.

Tenovos focuses on improving the customer experience using branded stories.

Pietra

NY-based creator hub Pietra raised US$15 million in series A funding led by Founders Fund. Abstract Ventures, Andreessen Horowitz, TQ Ventures, and other investors participated in the round.

Pietra is a platform that helps content creators connect with product and manufacturing companies. It allows them to market their products and earn revenue.

Aircall

Software marketplace Aircall announced a series D round of US$157 million led by Goldman Sachs Asset Management, with participation from current investors Adams Street Partners, Draper Esprit, DTCP, eFounders, Gaia Capital Partners, and NextWorld Capital. The round put the firm’s total funding at US$225.6 million. Aircall gives support and sales teams a tool to integrate calls and send out customer surveys.

G2

Chicago-based G2 raised US$157 million in series D funding led by Permira, with participation from existing investors Accel Partners, Emergence, and IVP. New investors also participated including Hubspot Ventures and Salesforce Ventures, alongside individual investor-entrepreneurs Auren Hoffman and Thomas D. Lehrman. With the deal, the company’s total funding reached US$257.6 million.

G2 is a site that helps buyers compare and select the best software with reviews and ratings.

Curate

Sales and operations platform Curate raised a US$1.25 million seed round led by OCA Ventures, with participation from Cultivation Capital, Jim McKelvey, and Stout Street Capital.

Curate is a tool for event organizers and professionals that allows them to send proposals, manage payments, and communicate with customers and suppliers.

Neo4j

San Mateo-based Neo4j announced US$325 million in series F funding led by Eurazeo, with participation from GV. Existing investors Creadum, Greenbridge Partners, and One Peak joined the round. New investors DTCP and Lightrock also participated. The deal brought the firm’s valuation to over US$2 billion. Neo4j is a graph database management system.

Bookclub

BookClub raised US$20 million in series A funding led by Signal Peak Ventures, with participation from Backstage Capital, GSV Ventures, and Pelion Venture Partners. Private investors Aaron Rasmussen (Outlier.org) and Otis Chandler (Goodreads) also participated.

Bookclub helps authors build stronger relationships with their readers, team up with other authors, lead discussions about their work, and share interviews to help readers learn more about a book.

Stoke Talent

CA-based talent management platform Stoke collected US$15.5 million in series A funding in a round led by Battery Ventures with participation from existing investors and angels Dynamic, Loop, and TLV Partners. This brought the firm’s total amount raised to US$20 million.

Stoke Talent makes it easy for companies to manage and work with freelancers and contractors.

Flyhomes

Seattle-based real estate and technology platform Flyhomes landed US$150 million in a series C round co-led by Battery Ventures and Norwest Venture Partners. Existing investors Andreessen Horowitz and Canvas Ventures alongside Balyasny Asset Management, Camber Creek, Fifth Wall, Spencer Rascoff, and Trustbridge Partners also joined the round. Flyhomes has raised a total of US$310 million across five rounds.

Flyhomes provides clients with a real estate expert, who manages their projects, along with other specialists to help them navigate the market.

Pattern

Pattern raised US$60 million from HOF Capital, Kleiner Perkins Caufield and Byers, Primary Venture Partners, RRE Ventures, RSE Ventures, and Victory Park Capital.

Pattern aims to help companies grow faster, protect their brand, and sell globally. The platform also offers marketing tools and data to increase sales.

Contentstack

San Francisco-based content management system Contentstack secured a US$57.5 million series B investment from Georgian Partners and Insight Partners, alongside existing investors Linnea Roberts (Gingerbread Capital) and Cidney Padnos (Illuminate Ventures). This brought the startup’s total investment size to US$89 million.

Contentstack allows marketers, developers, and content managers to collaborate on, create, and manage digital content.

Zenoti

Business management solution Zenoti extended its series D financing by accepting US$80 million from TPG, increasing the firm’s total valuation to nearly US$1.5 billion.

Zenoti helps businesses in the spa and salon industry schedule appointments, bill customers, and accept customer reviews. The app also alerts customers when they need to cut their hair.

Verbit

NY-based transcription and captioning platform Verbit secured a US$157 million series D funding round. Sapphire Ventures led the round with participation from new investors Azura, ICON Fund, More Capital, Omer Cygler, and Third Point, alongside existing investors ClalTech, HV Capital, Oryzn Capital, Stripes, Vertex Ventures and Vertex Growth, and Viola Ventures.

With the round, Verbit’s total funding exceeded US$250 million.

Verbit uses AI to deliver fast transcription and captioning solutions. The platform provides live and recorded videos with captions and transcriptions that are accessible to audiences.

Gong.io

AI-powered sales software Gong.io raised US$250 million in series E funding led by Franklin Templeton. Existing investors Coatue, Salesforce Ventures, Sequoia, Thrive Capital, and Tiger Global were also in on the round. The company claims to have over 2,000 companies using its platform including LinkedIn, MuleSoft, Paychex, PayPal, Shopify, Slack, Sprout Social, Twilio, and Zillow.

With the app, sales managers can listen to recorded calls, coach team members, track deals, and more.

Sharpen Technologies

IN-based Sharpen Technologies secured US$14 million in growth funding led by Bridge Bank and Multiplier Capital, with participation from existing investors including Cultivation Capital. The company has raised a total of US$46.7 million in funding.

Sharpen lets users work anywhere through real-time communication and integrates business calls, texts, and more into one platform.

DealHub.io

DealHub.io collected US$20 million in series B funding in a round led by Israel Growth Partners. Existing investor Cornerstone Venture Partners also joined the round. The round put the startup’s total funding at US$24.5 million.

DealHub aims to enhanve the entire sales process to provide teams with interactive and insightful solutions.

Outreach

Seattle-based sales platform Outreach landed US$200 million in funding in a round co-led by Premji Invest and STEADFAST Capital Ventures. The round brought Outreach’s total valuation to more than US$4.4 billion with a total of US$489 million in raised capital.

Outreach help sales teams and reps close deals and get insights.

Spiff

Sales compensation platform Spiff announced its series B funding round of US$46 million led by Lightspeed Ventures Partners, with participation from Salesforce Ventures and Stripes. Existing investor Norwest Venture Partners and all original investors were also in on the round. With the round, the firm’s total funding reached US$62 million.

Spiff aims to help businesses grow and manage commissions. The platform automatically calculates commissions and boosts team growth.

Martech startup funding news - May 2021

Breinify

San Francisco-based sales and marketing platform Breinify secured US$11 million in a round led by Gutbrain Ventures and PBJ Capital. Amino Capital, Startup Capital Ventures, Streamlined Ventures, Sterling Road, and The CXO Fund also participated in the round.

Breinify helps brands create and deliver personalized digital experiences across web, email, SMS, and apps.

Rightbound

Kirkland-based Rightbound raised US$12 million in a round led by Innovation Endeavors, with participation from IBI Tech Fund and Operator Collective. Existing angel investors Gil Shklarski, Nat Turner, and Zach Weinberg also joined.

Rightbound automates the sales development process to make it easier for teams to connect with relevant buyers.

Qualified

Sales and marketing platform Qualified announced US$51 million in series B financing led by Salesforce Ventures, with participation from existing investors Norwest Venture Partners and Redpoint Ventures. The startup had raised a total of US$68 million across three funding rounds.

The Qualified app identifies and tracks your ideal buyer, understands their intent, and instantly starts a conversation.

Klaviyo

Boston-based marketing automation platform Klaviyo raised a US$320 million series D round led by Sands Capital. Other new investors ClearBridge Investments, Glynn Capital, Keith Block, Lone Pine Capital, Morgan Stanley (Counterpoint Global), Owl Rock Capital, and Whale Rock Capital Management also joined alongside existing investors Accel and Summit Partners.

The startup increased its valuation to US$9.15 billion with a total of US$678.5 million in raised capital.

Klaviyo provides a platform to help identify customers and easily store, access, analyze, and use behavioral data to improve marketing campaigns.

Grin

Influencer marketing software Grin announced US$16 million in additional series A funding led by Imaginary Ventures, with participation from Good Friends Venture Capital.

Grin offers brands a tool for hiring influencers, tracking content, and creating discount codes.

Jifflenow

San Jose-based Jifflenow raised US$11.9 million in a round led by Trousdale Capital, with participation by existing investors Accel, Saama Capital, and Sequoia Capital.

Marketers and salespeople can use Jifflenow to schedule live and virtual events and simplify attendee registrations.

Crayon

Boston-based Crayon raised US$22 million in series B financing led by Baird Capital. Baseline Ventures, Bedrock Capital, C&B Capital, and Oyster Funds alongside Gaingels participated in the round. The deal brought the startup’s total disclosed funding to US$38 million.

Businesses can use Crayon’s market intelligence solution to win sales, save time and costs, track and analyze market activities and behaviors.

Gatheround

Community engagement platform Gatheround announced the launch of its platform along with a US$4 million investment co-led by Homebrew and Bloomberg Beta, with participation from Claire Hughes Johnson (Stripe), Lenny Rachitsky, Li Jin, and Scott Heiferman (Meetup).

Gatheround helps organizations establish and strengthen relationships with employees. The platform also offers templates to make cultural events easier to plan and facilitate.

Martech startup funding news - April 2021

Mux

US-based Mux, a video platform for developers, raised a US$105 million series D funding led by Coatue, with participation from existing investors Accel, Andreessen Horowitz (a16z), and Cobalt. New investor Dragoneer joined the round.

Mux has now raised US$175 million and entered the unicorn club. The app provides API to power video streaming and analytics for popular businesses like Reddit, Vimeo, Fox, and Udemy.

MOLOCO

US-based ad tech MOLOCO raised an undisclosed amount of series C funding led by Shinhan GIB, with participation from Smilegate Investment at a US$1 billion valuation. Prior to this, the firm had only raised US$15 million in two previous investment rounds.

MOLOCO uses AI to drive ad growth for mobile app publishers. The firm says it generates a profit from an annual run rate of US$400 million. If true, MOLOCO’s traction is impressive; the company claims to facilitate 7.5 billion ad impressions monthly to 2.5 million mobile apps. In the past four years, the business recorded around 180% growth annually.

Placer Labs

Location and foot traffic analytics firm Placer Labs raised a US$50 million series B funding round led by angel investors Josh Buckley, Todd Goldberg, and Rahul Vohra, with participation from Fifth Wall, JBV Capital, and Aleph VC. This round brings the firm’s total disclosed funding to US$66 million.

US-based Placer Labs offers retailers actionable insights related to offline visitors in specific areas. Users can also check visit trends, top performing locations, and cross-shopping patterns of customers.

Instreamatic

US-based audio ad platform Instreamatic closed a US$6.1 million series A investment led by Progress Ventures, with participation from Accomplice and Google Assistant Investments.

Instreamatic allows marketers to build and automate interactive voice advertising. Ads are published on music streaming apps or podcasts. Instead of a one-way audio ad, the firm’s interactive ad allows users to reply using voice to show their interest in the offer.

Databook

Customer intelligence platform Databook sealed a US$16 million series A investment led by Microsoft’s venture fund M12, with participation from Salesforce Ventures and existing investors Threshold Ventures, Haystack, and Firebolt. This brought the firm’s total investment to US$22 million.

Databook helps marketers and salespeople automatically segment customer data into insights (e.g. ranking target customers). This allows them to reclaim lost focus from the otherwise time-consuming work of building customer intelligence from scratch.

Mighty Networks

Online community platform Mighty Networks raised a US$50 million series B funding round led by Owl Ventures, with participation from new investors Ziff Capital Partners and LionTree Partners. Existing investors Intel Capital, Marie Forleo, Gretchen Rubin, Dan Rosensweig, Reid Hoffman, BBG Ventures, Lucas Venture Group, and Great Oaks Venture Capital also joined the round.

Brands and businesses can use Mighty Networks to build an online community. Inside the app, businesses can publish a variety of content like online courses, blog posts, and surveys. Users can also interact with fellow members on the platform.

Blu Digital Group (BDG)

BDG extended its series A financing by accepting an undisclosed amount of capital from the Gelman Brothers Family Investment Office. Prior to this, BDG had closed its series A round in January 2021 at an undisclosed amount.

BDG is a digital media software and services firm. The company helps video content distributors with licensing and distribution to streaming video services.

Copysmith

US-based machine learning copywriting assistance app Copysmith secured a US$10 million seed investment from Harmony Venture Labs, with participation from other investors advised by growth equity firm PSG.

Marketers can use Copysmith to create numerous copy ideas like sales emails and blog titles. The firm implements GPT-3 and in-house language models to produce accurate content with the help of AI.

Clubhouse

Audio-driven social network Clubhouse raised an undisclosed amount of series C funding led by Andrew Chen at Andreessen Horowitz, with participation from DST Global, Tiger Global Management, and angel investor Elad Gil. This latest round puts the startup’s valuation at US$4 billion.

Clubhouse allows users to host their own online talk shows. In February 2021, the firm shared that it reached 10 million weekly active users, a huge jump from 600,000 users in December 2020.

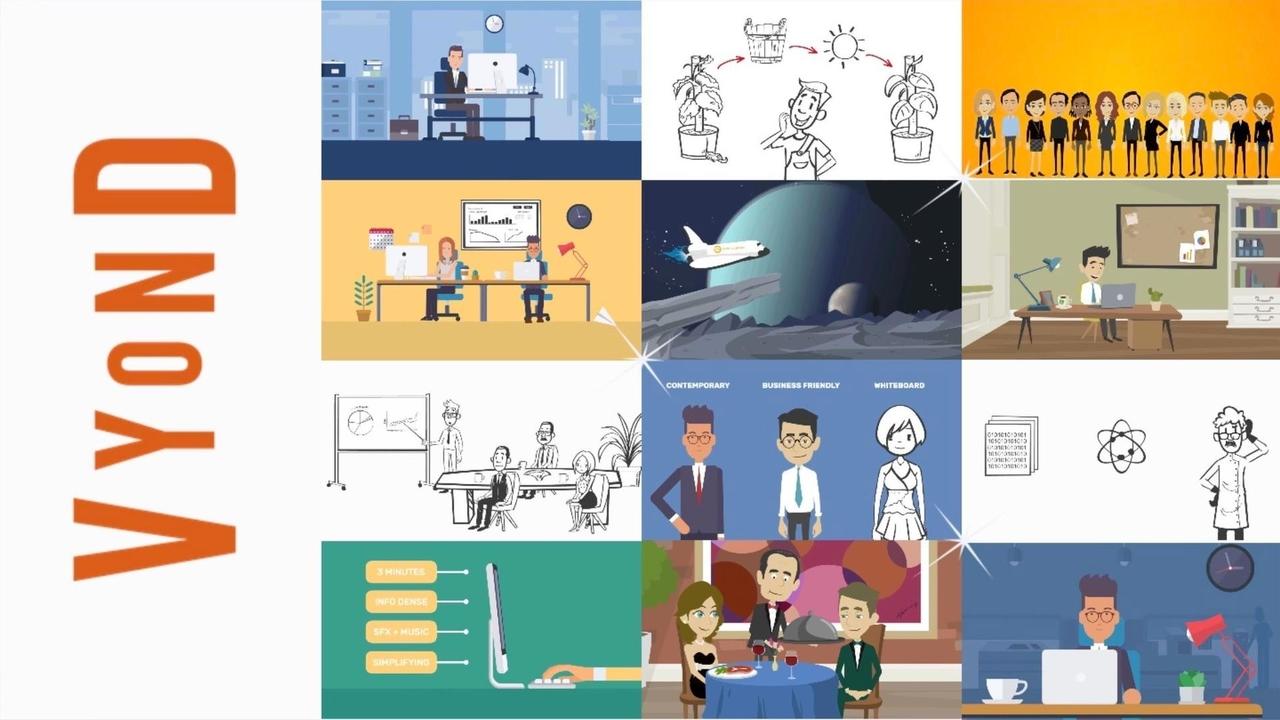

Vyond

US-based animated video SaaS platform Vyond raised US$50 million led by PeakSpan Capital. The startup helps marketers create animated video content easily. Launched in 2007, the firm has amassed around 20,000 customers from more than 150 countries.

Chili Piper

Chili Piper closed a US$33 million series B round led by Tiger Global, with participation from existing investors Base10 Partners and Gradient Ventures. This brings the startup’s total disclosed funding size to US$54.4 million.

Chili Piper helps marketers and salespeople automatically schedule meetings after leads fill out a form. The firm’s scheduling platform touts big names such as Square, Intuit, and Twilio as customers.

Pearpop

Pearpop secured US$10 million in series A funding led by Alexis, with participation from Bessemer Venture Partners. At the same time, the firm also announced its seed funding of US$6 million co-led by Ashton Kutcher and Guy Oseary's Sound Ventures and Slow Ventures, with participation from Atelier Ventures and Chapter One Ventures. This brings the startup’s total investment size to US$16 million.

The startup has also racked a huge number of prominent angel investors which include Abel Makkonen (The Weeknd), Amy Schumer, The Chainsmokers, Diddy, Gary Vaynerchuk, Griffin Johnson, Josh Richards, Kevin Durant (Thirty 5 Ventures), Kevin Hart (HartBeat Ventures), Mark Cuban, Marshmello, Moe Shalizi, Michael Gruen (Animal Capital), MrBeast (Night Media Ventures), Rich Miner (Android co-founder), Snoop Dogg, and Tyga. These big endorsements may help the startup land big names as early users like Heidi Klum and Tony Hawk.

Pearpop is a marketplace for content creators. Businesses and creators can publish paid challenges for TikTok users. For example, users can buy and sell duets, comments, and the use of the sound feature via Pearpop.

Scorpion

Internet marketing firm Scorpion raised a US$100 million series A investment from Bregal Sagemount. The startup provides end-to-end digital marketing services such as SEO, reviews, advertising, email marketing, and social media among others.

At the same time, the firm also announced that it has recently acquired SEO software firm CanIRank for an undisclosed sum.

Synthesia

Video AI startup Synthesia closed US$12.5 million in series A funding led by FirstMark Capital, with participation from angels Christian Bach (Netlify's CEO) and Michael Buckley (Twilio's VP Communications) along with existing investors LDV Capital, MMC Ventures, Seedcamp, Mark Cuban, Taavet Hinrikus, Martin Varsavsky, and TinyVC.

This brings Synthesia's total investment to US$16.6 million.

Synthesia uses AI to help marketers create presentation videos. Marketers can use their own face and voice to power the videos, or choose from the firm’s library of avatars instead. The company claims to have more than 1,000 paid customers currently.

Slice

Slice raised US$40 million in series D funding led by Cross Creek with participation from GGV Capital, KKR, Primary Ventures, as well as angels Dick Costolo (former Twitter CEO) and Adam Bain (former Twitter COO). With this latest round, the startup’s total funding size is now at US$125 million.

Slice empowers pizzerias with online marketing tools such as websites, data analytics, and marketplace. Launched in 2010, the startup now works with 15,000 independent pizzerias in 3,000 cities and 50 states in the US.

Snappy Kraken

Snappy Kraken (SK) secured a US$6 million series A investment led by FINTOP Capital, with participation from existing investors Flyover Capital and 1248 Holdings. The round brings the startup’s total funding to US$9.5 million.

SK helps financial advisors build an automated online marketing system which includes content creation, lead capture, and email marketing.

Alyce

The personal experience platform Alyce raised US$30 million in series B financing led by General Catalyst, with participation from existing investors Boston Seed Capital, Golden Ventures, Manifest, Morningside, and Victress Capital. This latest round brought the startup’s total capital raised to US$46.8 million.

Alyce helps B2B marketers use personalized corporate gifting to increase the overall conversion rate of their marketing and sales funnels. The platform uses AI to identify the prospect’s interests, then recommends personalized products to offer. Later, the platform can also help track and measure ROI based on whether the prospects eventually end up becoming customers.

OneSignal

Customer engagement platform OneSignal secured an undisclosed amount of investment from marketing software firm HubSpot. Prior to this round, One Signal had raised total funding of US$34 million.

Launched in 2012, OneSignal enables developers to install push-messaging capabilities via website, email, SMS, and mobile apps. The company claims to have worked with more than 1 million developers across 500,000 live apps.

AmazeVR

VR firm AmazeVR secured US$9.5 million in an undisclosed funding round led by Murex Partners, with participation from We Ventures, Bass Investment, and Dunamu & Partners. Existing investors Mirae Asset Venture Investment, Mirae Asset Capital, Partners Investment, and Timewise Investment also joined the round.

In addition to the firm’s series A and seed funding rounds, AmazeVR has now racked up US$25.3 million in capital.

AmazeVR provides an end-to-end VR solution for artists to create virtual concerts which includes content creation (gear and equipment to shoot VR concerts) and distribution (think: setting up offline pop-up booths or publishing content via online VR stores).

Gupshup

Messaging startup Gupshup raised US$100 million in series F funding from Tiger Global Management, increasing the firm’s valuation to US$1.4 billion. Gupshup is expecting to close more funding deals from more investors soon.

Gupshup’s API enables more than 100,000 developers and businesses to build messaging functions on their apps. Developers and marketers can also use Gupshup’s API to automate business conversations with chatbots. The firm claims that it has achieved profitability, while it continues to facilitate 6 billion messages per month.

Patreon

Patreon raised US$155 million in series F funding led by Tiger Global Management, with participation from Woodline Partners. Existing investors Wellington Management, Lone Pine Capital, New Enterprise Associates (NEA), Glade Brook Capital, and DFJ Growth also joined.

With this round, Patreon has raised a total of US$413.4 million, bringing the company’s valuation to US$4 billion.

Patreon is a monetization platform for content creators. So far, Patreon has helped more than 200,000 creators connect with 7 million fans. Since launching in 2013, the platform has disbursed more than US$2 billion in earnings for its creators.

Community

Text-marketing platform Community closed a US$40 million investment from Salesforce Ventures, bringing the startup’s total funding to US$90 million.

The firm tries to put a fresh spin on SMS marketing, allowing people to subscribe to influential individuals (like celebrities) via SMS. Community claims to have facilitated the exchange of more than 3 billion text messages since re-launching in July 2019.

Casted

Video and audio marketing tool Casted closed US$7 million in series A financing led by Revolution Ventures, with participation from current investors High Alpha Capital, Elevate Ventures, and Tappan Hill Ventures. This round brough the firm’s total funding to US$9.5 million.

Casted helps B2B marketers improve their audio and video content by spinning out helpful multimedia from it (think: short video clips or social media captions). Casted can also provide analytics and a platform to manage all content in one place.

Grata

B2B search engine Grata raised US$6.3 million in additional seed funding led by Bling Capital, with participation from Flex Capital and Touchdown Ventures. Existing investors like Accomplice and Alumni Ventures also joined.

With the company raising US$3.2 million in the previous round, in total, Grata has collected US$9.5 million in seed capital.

Grata is a search engine for SMB company discovery. Marketers can use the app to conduct lead gen, while investment firms can uncover exciting companies to back. Grata indexes billions of pieces of content from the web and uses NLP tech to map the data.

Sendbird

Chat platform Sendbird closed US$100 million in series C financing in an oversubscribed round led by STEADFAST Capital Ventures, with participation from Emergence Capital, Softbank Vision Fund 2, and World Innovation Lab. Existing investors ICONIQ Growth, Tiger Global Management, and Meritech Capital also joined.

In total, the firm has raised US$220.7 million in funding.

With Sendbird’s API, companies can embed chat, voice, and video functions into their apps easily. The firm counts popular names like Reddit, Delivery Hero, and Paytm among its users.

Holler

Conversation media platform Holler raised a US$36 million series B round co-led by CityRock Venture Partners and New General Market Partners, with participation from Gaingels, Interplay Ventures, Relevance Ventures, Towerview Ventures, and WorldQuant Ventures.

Since launching in 2013, the company has amassed a total of US$51.4 million in funding.

Holler helps companies enrich their user experience with relevant content suggestions. For example, the app is the one that powers Venmo’s sticker and GIF suggestion function. The company claims that it’s now facilitating close to 1 billion messages each day.

Fetch Rewards

Loyalty platform Fetch Rewards announced it has raised US$210 million in series D funding led by SoftBank Vision Fund 2, with participation from existing shareholders ICONIQ, DST, Greycroft and e.ventures. In total, the startup has now raised US$328 million in capital and reached unicorn status.

Launched in 2013, Fetch Rewards enables retail stores to build loyalty programs. The app has recorded more than 19 million downloads with close to 7 million active users. To date, the startup has processed close to a billion receipts, and delivered more than US$120 million in savings for shoppers.

Martech startup funding news - March 2021

Uniphore

India-based Uniphore raised US$140 million in series D funding led by Sorenson Capital Partners. Other investors included Serena Capital, Sanabil Investments, and Cisco Investments. Existing investors March Capital Partners, National Grid Partners, Chiratae Ventures, Iron Pillar Fund, and Sistema Capital also participated in the round.

The deal brought the startup’s total disclosed funding to US$210 million.

Uniphore offers conversational AI solutions designed to help automate customer service. Clients can also monitor and verify their agents’ identities using voiceprints, as well as trigger specific tasks during and after calls (e.g. automatically creating a call summary after each call). The firm has offices in India, the US, and Singapore.

Redeam

US-based Redeam raised a US$12 million series B round led by Vertical Venture Partners and Thayer Ventures. Other participating investors include Boulder Ventures, Peninsula Ventures, and Cobre Capital.

Redeam enables tours, attractions, and activities operators to easily accept and process online and offline bookings (via paper tickets or online vouchers) from resellers. With Redeam, operators can reduce manual processes and offer guests a better check-in experience.

TripleLift

US-based TripleLift signed an agreement to receive a majority investment from Vista Equity Partners. Brands can use TripleLift’s programmatic ad solutions for native advertising, branded content, and OTT.

Clients can customize their campaigns or purchase pre-packaged ad placements on TripleLift.

Daasity

US-based Daasity raised US$3.4 million in seed funding led by VMG Partners, with participation from Centre Partners and a group of e-commerce founders and operators. Daasity’s existing investors include Exeter Capital, 1855 Capital, Mooring Ventures, Okapi Venture Capital, and Serra Ventures.

Daasity is an omnichannel analytics platform for direct-to-consumer brands. The startup empowers merchants to easily aggregate and visualize data from different sources like Google Analytics, Shopify, and Amazon.

ActionIQ

US-based ActionIQ extended its total C stage funding to US$100 million, up from the US$32 million it grabbed in January 2020. The latest deal came from existing investors FirstMark, March Capital, and Balius Partners.

ActionIQ is a platform that helps companies connect customer data across all brand touchpoints like website, social media, sales data, and ads.

TryNow

US-based TryNow completed a US$12 million series A investment round from Shine Capital, Craft Ventures, SciFi VC, Third Kind, and Plaid co-founders Zachary Perret and William Hockey.

TryNow’s tech enables Shopify Plus merchants to offer customers the ability to try out the items first, before committing to purchases. Use cases include customers being able to check out multiple outfits from an online store with zero fees. They try out the clothes at home for a few weeks, and then pay for what they keep.

OpenReel

US-based OpenReel raised US$19 million for its series A round from Five Elms Capital. OpenReel’s platform allows enterprises to do remote collaboration when capturing HD videos.

Yotpo

US-based Yotpo secured a US$230 million series F investment led by Bessemer Venture Partners and Tiger Global, with participation from existing investors Claltech Investment, Coin Ventures, Hanaco, Vertex Ventures, Vintage Investment Partners, among others.

Yotpo offers a slew of e-commerce marketing solutions, including SMS marketing, customer reviews and ratings, loyalty programs, and referrals. The firm currently has offices in three countries: the US, Israel, and the UK.

Squarespace

US-based Squarespace closed approximately US$300 million at a staggering valuation of US$10 billion. The investment came from new investors Dragoneer, Tiger Global, D1 Capital Partners, Fidelity Management & Research Company, funds and accounts advised by T. Rowe Price Associates, Inc., and Spruce House with participation from existing investors Accel and General Atlantic.

Squarespace is an all-in-one website builder. Users can create a wide range of sites using the firm’s templates and make use of a variety of its marketing solutions such as email marketing and blog. Squarespace is poised to go public in the US later this year.

SafeGraph

US-based SafeGraph raised a US$45 million series B funding round led by Sapphire Ventures, with participation from existing investors including Alex Rosen of Ridge Ventures, DNX Ventures, and Peter Thiel.

SafeGraph is an analytics platform that allows offline businesses to get point of interest and foot traffic data in the US and Canada. This helps them gain insights such as traffic demographics and the estimated number of people walking by specific locations.

Postscript

US-based Postscript secured a series B investment of US$35 million led by Greylock, with participation from YC Continuity Fund, OpenView, and others.

Postscript is an e-commerce SMS platform for Shopify merchants. The startup aims to help sellers emulate email marketing on SMS, including list building, automated SMS based on customer actions (e.g. abandoned cart), and analytics.

Banzai

US-based Banzai completed a US$15 million venture debt funding round led by Columbia Pacific Advisors. Banzai helps marketers manage virtual events, which includes promotion, hosting, recording, and analytics.

KUDO

US-based KUDO secured a US$21 million series A investment led by Felicis Ventures, with participation from Maverick Ventures, Elephant VC, FJ Labs, Global Founders Capital, and Bill Ackman in an oversubscribed round. This brought KUDO’s total funding to nearly US$28 million.

KUDO enables marketers to stream multilingual video conferences and webinars with real-time language interpretation. This allows everyone to speak and listen in their mother tongue. KUDO does this by connecting video hosts with global interpreters inside the platform.

6sense

US-based 6sense raised a US$125 million series D investment led by D1 Capital Partners, with participation from Sapphire Ventures, Tiger Global, and Insight Partners. This latest round brought the startup’s valuation to US$2.1 billion.

As an AI-based predictive sales and marketing platform, 6sense unifies silos of data to provide actionable insights for marketers. For example, the platform can help identify potential purchasing opportunities from visitors that browse through a brand’s various business channels, including website, blog, chatbot, and email.

DotPe

India-based DotPe raised a US$27.5 million series A round led by PayU, with participation by Info Edge Ventures and Google. The startup enables brick-and-mortar stores to build digital product catalogues and facilitate online payments via WhatsApp.

Zeta Global

US-based Zeta Global raised US$222.5 million in debt financing led by BofA Securities, with participation from Barclays, Credit Suisse, and Morgan Stanley Senior Funding.

The startup provides a customer data management platform that helps marketers connect first-party user data from different channels inside one dashboard. The platform can then segment and score each lead and help marketers do omnichannel engagements using tools such as ads, website personalization, and social media.

Calixa

US-based Calixa bagged a US$4.25 million seed round led by Kleiner Perkins, with participation from Operator Collective, Liquid 2 Ventures, and other individual investors.

Calixa provides a customer ops platform for SaaS firms, allowing marketers to get a unified view of their customers from different apps (think Zendesk, Stripe, etc). Marketers can then set up alerts based on customer actions and manage third-party apps inside Calixa’s app.

Tezign

China-based Tezign secured an undisclosed amount of C2 stage funding led by Temasek Holdings, with participation from Unicorn Capital Partners, C Ventures, SoftBank China Venture Capital, Sequoia Capital China, Hearst, Linear Capital, Eminence Ventures, and Cherubic Ventures. This latest round brought the company’s total series C funding to US$100 million.

Tezign provides design solutions for SMEs and larger enterprises by matching them with suitable designers via AI and image recognition tech. Corporate clients can then collaborate with designers at scale - either for content creation, consultation, and training -- inside Tezign’s app.

ExtraaEdge

India-based ExtraaEdge secured US$1 million in pre-series A funding led by Pentathlon Ventures, with participation from 9Unicorns, Indian Angel Network, Faad Network, DevX Innovation, Sprout Venture Partners, TiE Pune Angels, and angel investors.

ExtraaEdge provides marketing solutions (such as a CRM, chatbots, and email marketing) for the education sector. School and university marketers can integrate their campaigns into the admission process (think video counselling calls, etc) in one place.

Circus Social

India-based Circus Social raised a US$1 million pre-series A round led by Inflection Point Ventures, with participation from angel investors based in the US, Singapore, and India.

Circus Social offers a host of social media functions for marketers, including social listening, competitor intelligence, KOL discovery and tracking, and trend spotting.

RD Station

Brazil-based RD Station was acquired by local enterprise software giant Totvs to the tune of US$32.5 million, making it the nation’s biggest acquisition to date in the software industry.

RD Station provides a host of marketing tools under one roof, including page and form builders, email marketing, social media marketing, and online ads. By managing all campaigns on one app, marketers can easily view and understand customer data on a single dashboard. RD Station is one of Brazil’s marketing SaaS firms with more than 25,000 corporate users.

Martech startup funding news - February 2021

GiveSignup

Engagement platform GiveSignup closed a US$3.2 million series A funding led by Payroc. New investors Sacha Labourey (CloudBees) and Randy Befumo (former CFO at Eventbrite) also joined the round. The firm claims to be trusted by more than 22,000 endurance races and events, and supports more than 9,000 nonprofits annually.

Moorestown-based GiveSignup aims to elevate nonprofits’ revenue generation and supporter engagement. Built on an integrated CRM, it claims to be an all-in-one solution powering nonprofits from ticketing and registration to donations and fundraising.

Terminus

Terminus announced its series C funding of US$90 million led by Great Hill Partners. Existing investors Atlanta Ventures, Edison Partners, and Hallett Capital also participated in the round. The firm claims to have over 1,000 customers including DHL, G2, Outreach, and TripActions.

Terminus aims to offer account-based marketing at scale. It has set out to help sales and marketing teams take action on their data to grow their pipeline, launch more personalized campaigns, and execute multi-channel ABM for better engagement.

Levitate

Raleigh-based marketing platform Levitate raised an US$8 million series B round, increasing the firm’s total raised capital to US$20 million. Lipson along with existing investors Bull City Venture Partners, Peter Gassner, and Tippet Venture Partners were also in on the round.

Levitate is designed to help small businesses owners take control, with personalized email templates.

Blueshift

Blueshift raised a US$30 million series C round led by Fort Ross Ventures alongside Avatar Growth Capital. Existing investors also participated, including Conductive Ventures, Nexus Venture Partners, Softbank Ventures Asia, and Storm Ventures. This round brought the firm’s total disclosed funding to US$65 million.

Blueshift aims to easily connect your data and drive growth with customer-centric campaigns across all of your marketing channels.

Emotive

LA-based Emotive closed a US$50 million series B round led by CRV, with participation from existing investors Mucker Capital and TenOneTen Ventures, alongside new investors Stripes and Vulcan Capital. The deal increased the company’s valuation to US$400 million.

Brands use Emotive’s messaging platform to boost revenue, get in touch with their customers, build loyalty, and release new products.

SoundCommerce

Data platform SoundCommerce announced its series A funding round of US$15 million led by Emergence Capital. Existing investors Defy Partners and Voyager Capital also participated in the round.

SoundCommerce’s aims to drive profitable growth, customer experience, and lifetime value across retail systems and channels — from first click to doorstep delivery.

Creatio

Boston-based software company Creatio raised US$68 million in funding led by Volition Capital, with participation from Horizon Capital.

Creatio aims to automate industry workflows and CRM with no-code and a maximum degree of freedom.

Pex

LA-based Pex secured US$57 million in funding, with participation from existing investors Amaranthine, Cue Ball, Illuminate Ventures, NextGen Venture Partners, Susa Ventures

Tencent Holdings, and Tencent Music Entertainment.

Pex aims to be the copyright solution for the creator economy. It supports platforms, rightsholders, and creators with copyright compliance, real-time licensing, and dispute resolution.

Matillion

Matillion announced a series D funding of US$100 million led by Lightspeed Venture Partners, with participation from Battery Ventures, Sapphire Ventures, and Scale Venture Partners.

The firm’s total valuation reached US$1.5 billion and its total raised capital came to US$310.3 million.

Matillion aims to provide analytics-ready data in minutes with cloud-native data integration.

MutualMarkets

NY-based AI platform MutualMarkets raised US$3 million in seed funding led by Greycoft and Bessemer Venture Partners, with participation from Gerald S. Hobbes (BV Investment Partners), Itzhak Fisher (PEREG Ventures), Michael Kempner (MWWPR), Russell Farscht (former Managing Director, Carlyle), and Peak Opportunity Partners.

MutualMarkets aims to unlock the power of co-marketing to improve your ad results, increase your short term success, and bolster long term brand health.

Aidentified

Boston-based AI-powered sales intelligence Aidentified had raised US$10 million in series A funding from Darr and Tom Aley.

Aidentified aims to reveal the best paths for sales teams, account execs, and brands to connect to hyper-targeted, qualified prospects using predictive analytics and next level AI-based relationship intelligence mapping.

Opiniion

UT-based Opiniion raised US$1.5 million in second seed funding led by RET Ventures. The platform provides tools to help businesses get online reviews, interact with customers, and collect authentic feedback quickly.

Leadspace

San Francisco-based Leadspace secured US$46 million in series D funding led by Jerusalem Venture Partners. The round brought the firm’s total funding to US$107 million.

Leadspace helps B2B marketers use data and AI to improve engagement with visitors and strengthen sales and marketing.

Tealium

San Diego-based Tealium raised US$96 million in series G funding led by existing investors Georgian and Silver Lake Waterman.

Businesses can use Tealium’s drag-and-drop tool to improve their marketing and website performance without spending too much on tech costs.

Martech startup funding news - January 2021

SetSail

San Mateo-based SetSail secured US$26 million in series A funding from Insight Partners, with participation from existing investors Operator Collective, Team8 Capital, and Wing Venture Capital. The deal brought the company’s total funding to US$37 million.

SetSail aims to leverage data science along with a unique reward model to achieve productivity gains for customer-facing teams.

Playvox

Sunnyvale-based customer service agent software Playvox announced a US$25 million round from Five Elms Capital. In total, the startup has now raised US$34 million in capital. Playvox claims to work with a variety of prominent customers including Dropbox, Electronic Arts, and Wish.

Playvox aims to remove the pain from quality assurance and employee scheduling, while simplifying agent motivation, coaching, and training.

Raydiant

SF-based experience management platform Raydiant closed a US$13 million series A funding deal led by 8VC and Atomic, with participation from BN Capital (Lerer Hippeau), Delta Zulu, Gaingels, and Mark Wahlberg.